Back in 2018, at my previous workplace, we had a bit of a tradition. Every month or so, stalls would pop up, selling everything from clothes to toys and other knick-knacks. During one of those fairs, I connected with a mutual fund advisor and struck up a conversation about investing. He recommended three funds, one of which was the Mirae Asset Emerging Bluechip Fund. Since I was investing through an advisor, it would be a regular plan.

Now, I was fully aware of the higher expense ratio that comes with a regular plan. But given that my earlier picks—HSBC ELSS Tax Saver Fund (erstwhile L&T Tax Advantage Fund) and Motilal Oswal Long Term Equity Fund—hadn’t quite met my expectations, I figured it was worth getting some professional help this time.

As the months went by and I saw how this fund was performing, I wanted to increase my SIP amount. However, Mirae Asset had placed inflow restrictions on the fund due to its rapid growth and rising AUM. So, I continued with the original SIP amount.

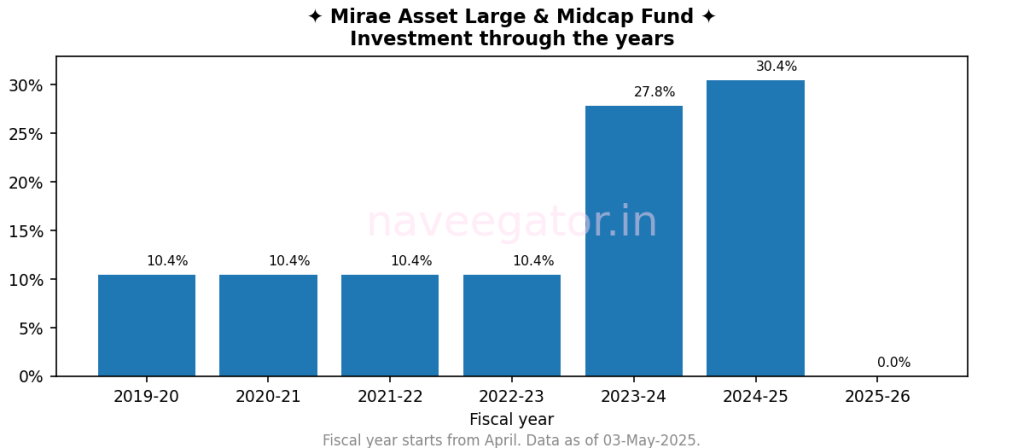

In Oct’23, when Mirae Asset increased the SIP cap, I didn’t waste time. I started a new SIP in the direct plan to benefit from the lower expense ratio, while continuing the old SIP in the regular plan. That’s why you’ll see a noticeable increase in my investment from FY 2023–24 (see Figure 1). Just a month later, in Nov’23, the fund was renamed to Mirae Asset Large & Midcap Fund.

By Nov’24, I paused both SIPs—regular and direct—as I’d invested in a home to diversify my investments and needed capital for the same.

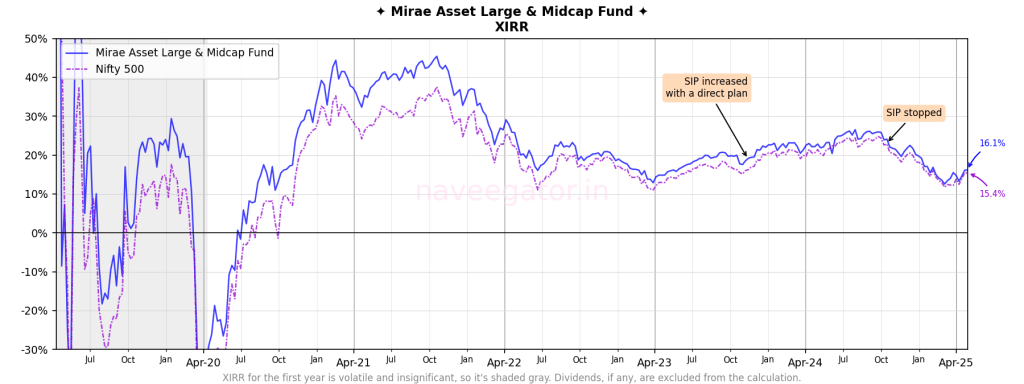

The fund’s benchmark is the Nifty Large Midcap 250 TRI. But since I couldn’t find clean, consistent data for it, I chose to compare the fund’s performance against the Nifty 500 Index instead. Over the years, the fund has consistently outperformed the Nifty 500 (see Figure 3).

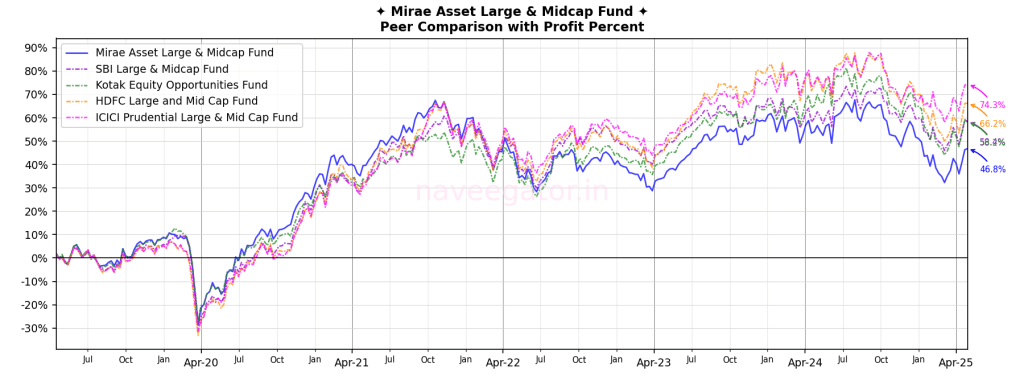

While this comparison looks impressive, things change when I compare the Mirae Asset Large & Midcap Fund with its peers. I’ve compared it with the following direct plans, and Figure 4 shows the profit percentage for each:

- SBI Large & Midcap Fund

- Kotak Equity Opportunities Fund

- HDFC Large and Mid Cap Fund

- ICICI Prudential Large & Mid Cap Fund

Mirae Asset’s fund was a top performer until Oct’21. But since then, its performance has deteriorated, and it’s currently the lowest among its peers.

Still, I’m hopeful that in the coming years, the Mirae Asset Large & Midcap Fund will recover and close the gap in performance.

You must be logged in to post a comment.