Back in 2019, at my previous workplace, we had a bit of a tradition. Every month or so, stalls would pop up, selling everything from clothes to toys and other knick-knacks. During one of those fairs, I connected with a mutual fund advisor and struck up a conversation about investing. He recommended three funds, one of which was the Axis Bluechip Fund. Since I was investing through an advisor, it would be a regular plan.

Now, I was fully aware of the higher expense ratio that comes with a regular plan. But given that my earlier picks—HSBC ELSS Tax Saver Fund (erstwhile L&T Tax Advantage Fund) and Motilal Oswal Long Term Equity Fund—hadn’t quite met my expectations, I figured it was worth getting some professional help this time. As you read along and see the performance of Axis Bluechip Fund, you will realise that getting professional help, hasn’t helped much. And this is not to put shade on my mutual fund advisor. It is just that some events—as you will read later—are really beyond anyone’s control.

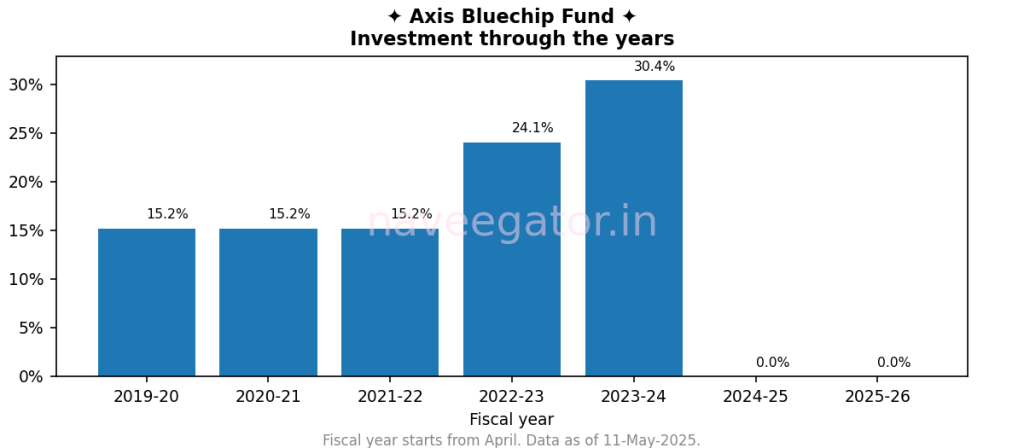

I have stayed with Axis Bluechip Fund for five years starting FY 2019-20. In Sep’22, I decided to increase my SIP. However, this time, I opted for the direct plan to reduce the expense ratio. As a result, this analysis includes investments made through both the regular and direct plans. You can see the uptick in my investments since FY 2022-23 in Figure 1.

When I decided to stop all my SIPs—which was in Mar’24—it was due to over-diversification in my mutual fund portfolio, and I wanted to concentrate on fewer funds. Also, in my analysis, index funds were offering better returns. I am not particularly concerned with the expense ratio because if the fund is able to outperform its benchmark index, I am willing to pay that expense.

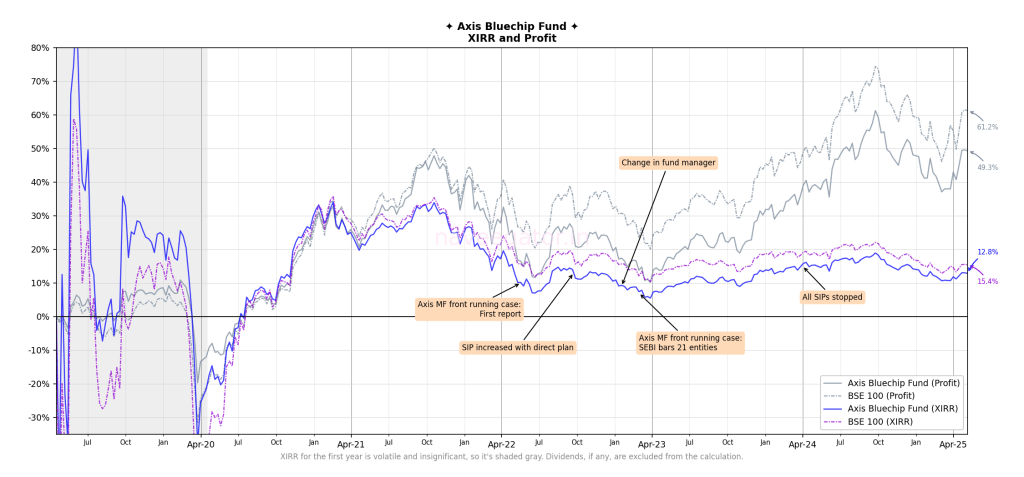

The journey had a hiccup along the way. In May’22, reports emerged about some people within Axis Mutual Fund being involved in front running. SEBI took action against it, but the news had a noticeable impact on the performance of the Axis Bluechip Fund. Since the revelation, the fund has been underperforming its benchmark, the BSE 100. Although the difference in XIRR is just 2.6%, when I calculated the actual profit, I found that the underperformance compared to the BSE 100 exceeded 10% (Figure 2).

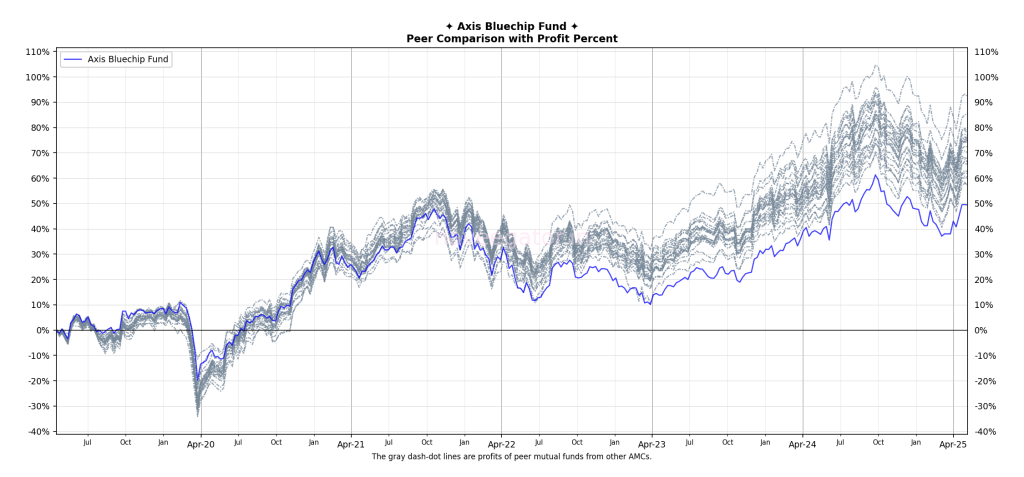

Not only is Axis Bluechip Fund underperforming its benchmark, but it is also underperforming all—I mean all—its peer mutual funds from other AMCs. To get the list of all peer mutual funds, I reviewed Crisil’s mutual fund ranking and compared the profit of Axis Bluechip Fund against each of them. You can see the analysis in Figure 3.

No wonder Axis Bluechip Fund is ranked 5—the lowest ranking—in Crisil’s mutual fund ranking. The ranking data is as of 11-May-2025. Below table shows how each of the peer mutual fund’s profit would have been had I invested in them. Note, I have considered direct plans for all the peer mutual funds.

| Mutual Fund | Profit Percent |

|---|---|

| Nippon India Large Cap Fund | 92 |

| ICICI Prudential Bluechip Fund | 85 |

| Invesco India Largecap Fund | 79 |

| DSP Top 100 Equity Fund | 78 |

| HDFC Large Cap Fund | 77 |

| Canara Robeco Bluechip Equity Fund | 76 |

| Baroda BNP Paribas Large Cap Fund | 75 |

| Kotak Bluechip Fund | 75 |

| Edelweiss Large Cap Fund | 75 |

| Mahindra Manulife Large Cap Fund | 75 |

| Bandhan Large Cap Fund | 74 |

| Aditya Birla Sun Life Frontline Equity Fund | 72 |

| Tata Large Cap Fund | 70 |

| SBI Blue Chip Fund | 68 |

| Franklin India Bluechip Fund | 67 |

| JM Large Cap Fund | 66 |

| HSBC Large Cap Fund | 65 |

| UTI Large Cap Fund | 63 |

| Mirae Asset Large Cap Fund | 62 |

| Taurus LargeCap Equity Fund | 61 |

| Union Largecap Fund | 60 |

| PGIM India Large Cap Fund | 58 |

| LIC MF Large Cap Fund | 57 |

| Axis Bluechip Fund | 49 |

Seeing your investment perform at the absolute last place does hurt. And paying an extra expense with regular plan adds a pinch of salt to that wound. But then as they say—Mutual fund investments are subject to market risks, read all scheme related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of future performance of the schemes.

Hoping that the past performance doesn’t continue and Axis Bluechip Fund is able to pull ahead in the future.

You must be logged in to post a comment.