My investment in DSP ELSS Tax Saver started as a way for me to save tax. When I started, I had selected two funds for my ELSS investments, the other one being L&T Tax Advantage Fund. Back then the conventional wisdom to save tax was to invest in ELSS rather than PPF for 80C. Especially if you are young and have a long road ahead of you.

I went via the SIP route and my initial three SIPs were in regular plan. After reading a bit more, learning about direct plans and their lower expense ratios I paused the regular plan SIP and moved to a direct plan.

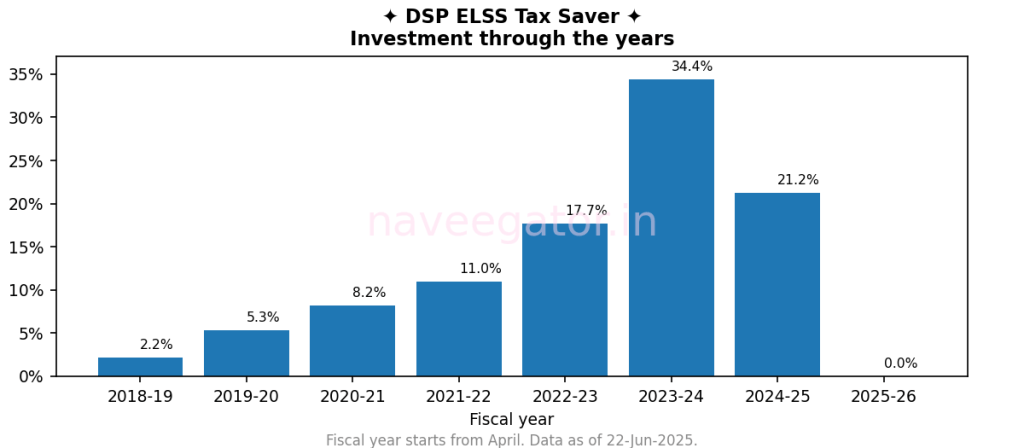

During my initial years the SIP amount was very low. You can see in Figure 1 that the total investment I made in DSP ELSS Tax Saver Fund during FY 2018-19 is just 2.2% of my overall investments. But as I was tracking the performance of DSP ELSS Tax Saver, I realised the fund was significantly outperforming my other investments—both equity and mutual funds. This prompted me to steadily increase my investments year or year. Come every April and I would increased my SIP amount. The percentage didn’t matter. I increased to whatever I thought I could manage for the next one year. I also sprinkled lump sum investments in between my SIPs—sometimes because I had surplus money to invest, others when the markets were in a tizzy due to some or the other global events.

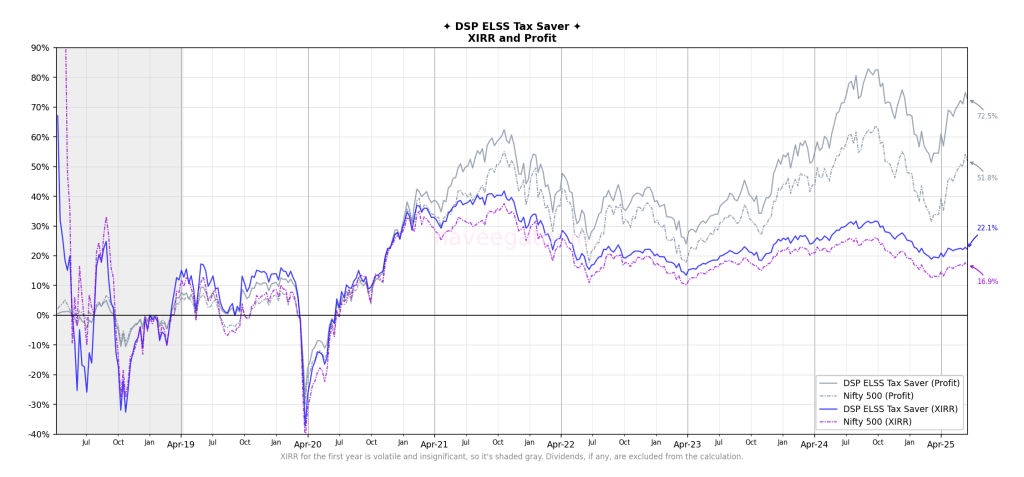

DSP ELSS Tax Saver Fund’s benchmark is Nifty 500. And in the seven years, it has beaten the index since last six years (Figure 2). Now that’s what I call an outperformance. The outperformance is also on the higher side, with Nifty 500 at 16.9% XIRR while the fund at 22.1% XIRR.

Peer comparison

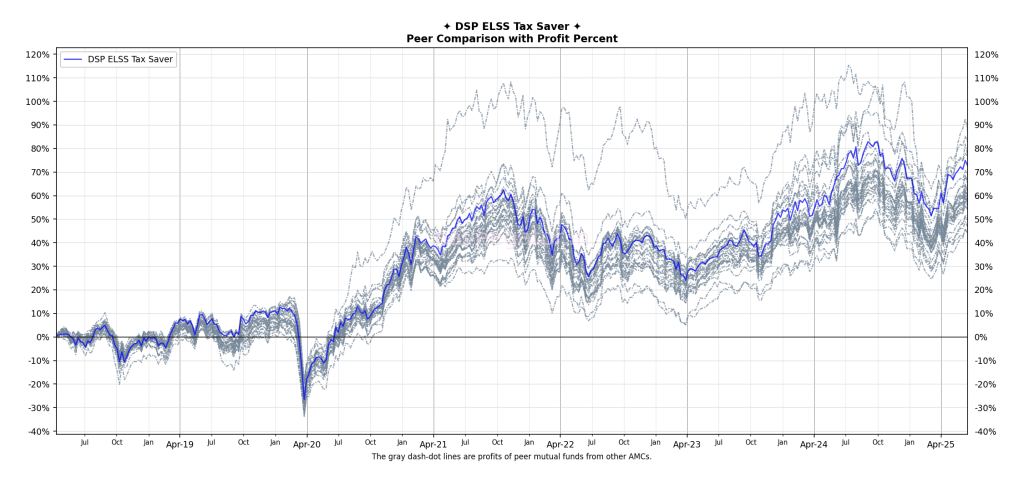

Comparing DSP ELSS Tax Saver against its peers also paints a promising picture. I compared DSP ELSS Tax Saver Fund with all the other ELSS funds from other AMCs (Figure 3). Throughout the seven years, the fund has come in the top 5 to 10 funds and as of today it is in the top 5 funds (Table 1). And that is what I was looking for. Not the topmost performing fund. Just a fund which is among the top funds. That was good enough for me.

| Mutual Funds | Profit Percent |

|---|---|

| Motilal Oswal ELSS Tax Saver | 87.5 |

| SBI Long Term Equity | 82.7 |

| Quant ELSS Tax Saver | 77.2 |

| HDFC ELSS Tax Saver | 76.8 |

| DSP ELSS Tax Saver | 72.5 |

| Franklin India ELSS Tax Saver | 68.8 |

| HSBC ELSS Tax saver | 66.1 |

| Bank of India ELSS Tax Saver | 64.5 |

| Mirae Asset ELSS Tax Saver | 62.4 |

| Bandhan ELSS Tax Saver | 62.0 |

| Nippon India ELSS Tax Saver | 61.6 |

| Quantum ELSS Tax Saver | 60.4 |

| Baroda BNP Paribas ELSS Tax Saver | 60.3 |

| Invesco India ELSS Tax Saver | 59.8 |

| Edelweiss ELSS Tax Saver | 59.1 |

| Mahindra Manulife ELSS Tax Saver | 58.2 |

| Canara Robeco ELSS Tax Saver | 58.1 |

| ICICI Prudential ELSS Tax Saver | 57.4 |

| Tata ELSS Tax Saver | 57.3 |

| Taurus ELSS Tax Saver | 56.8 |

| LIC MF ELSS Tax Saver | 56.2 |

| Union ELSS Tax Saver | 55.8 |

| PGIM India ELSS Tax Saver | 54.1 |

| Sundaram ELSS Tax Saver | 54.0 |

| UTI ELSS Tax Saver | 50.3 |

| Groww ELSS Tax Saver | 49.3 |

| Navi ELSS Tax Saver | 46.7 |

| Axis ELSS Tax Saver | 44.0 |

| Aditya Birla Sun Life ELSS Tax Saver | 44.0 |

* Data as of 22-Jun-2025

When I look back and see, I think I was just lucky that to pick this fund. Because there was really no methodology in my selection process. But then when I look into the future I am reminded of—The past performance of the mutual funds is not necessarily indicative of future performance of the schemes.

Let’s hope the future is as kind as the past was to me.

You must be logged in to post a comment.