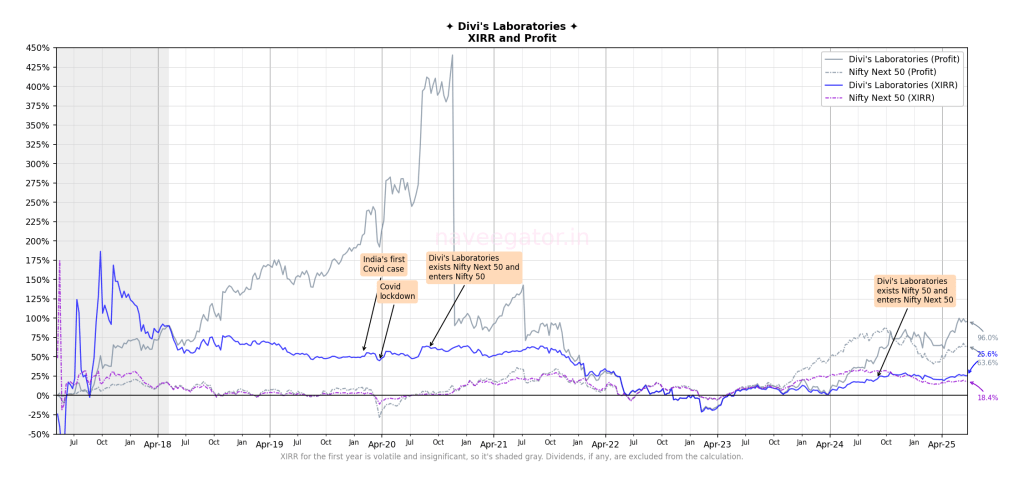

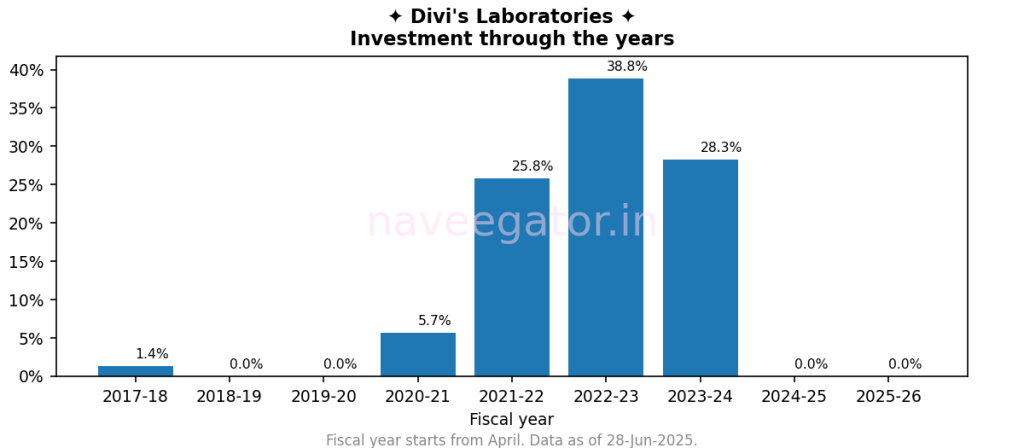

My investment in Divi’s Laboratories has been my biggest missed opportunity. Eight years back—still new to equity investing—I was looking for pharma stocks to invest. During that research—not sure if I should call it research, but let’s go with it—I came across Divi’s Laboratories. I made a small investment in it and forgot about it. In the next 3.5 years the stock went up 5 times! (Figure 1) And I did not make a single new investment during that time! (Figure 2) Every time I thought “it can’t go up any further than that”. Boy was I wrong. So, so wrong!

When I realised my mistake and started making additional investments from FY 2020-21, the stock—on the other hand—was volatile. During Apr’23 the stock went on a downward spiral and my XIRR went to -20%. What happened at that time? Finshots has an explanation for that.

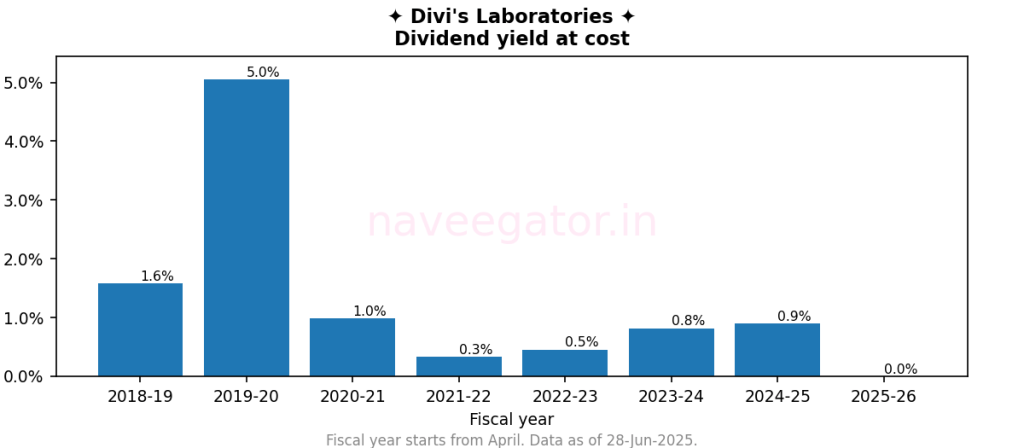

After a painful under performance which lasted two years—Jun’22 to Jun’24—Divi’s Lab has rebounded and is now beating both Nifty 50 and Nifty Next 50 (Figure 1). The dividend yield at cost which was very impressive—and unrealistic—during the initial days is now on a much more realistic level of 0.9% (Figure 3).

You must be logged in to post a comment.