Somewhere in June 2015, I got a call from ICICI Direct that I had been assigned a relationship manager and he wanted to help me with my equity investments. Being naive to the world of equities, I decided to give it a try. I met my relationship manager and he helped me setup my ICICI Direct account.

“Which stock should I buy to start with?” I asked my relationship manager.

“HDFC Bank”

“What? And not ICICI Bank? But you work for ICICI Bank!”

“Because HDFC Bank is better.”

I heeded to his advice and bought my first shares of HDFC Bank. It has been ten years since that.

A lot has happened in the last ten years. Pandemic. Wars. HDFC Bank merging with HDFC. More wars. Rise of AI, which now threatens my future employment. Some more wars. Through all this I not only held onto my investment in HDFC Bank but also increased it. Just so I could write this post about my journey.

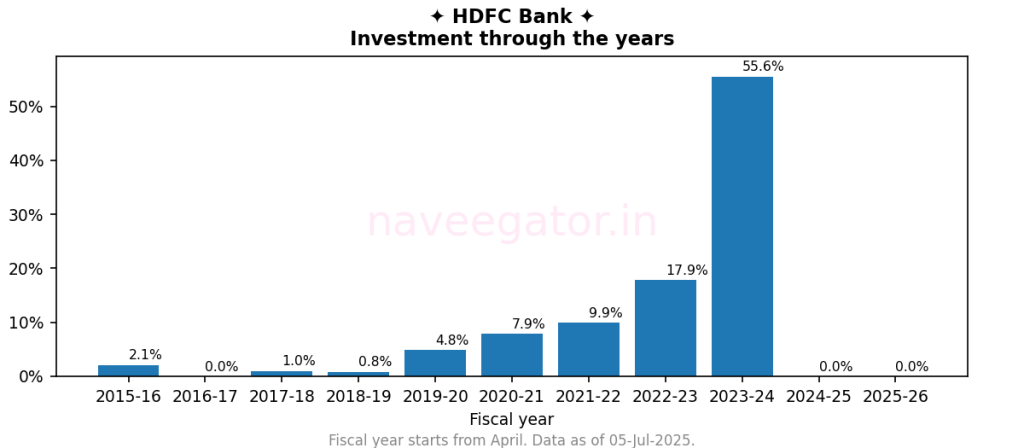

The initial years (Figure 1) was just dipping my feet in the water. I remember I bought one HDFC Bank share during the initial days. One share. When the contract statement came in the next day and I saw the brokerage amount, I had to pickup my jaw from the floor. Lesson learnt the hard way.

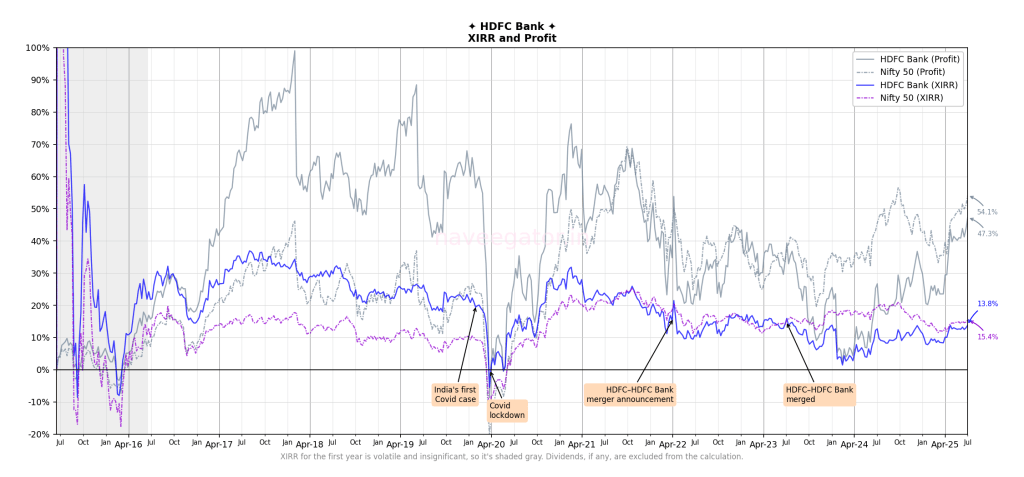

There were two significant events during which I substantially increased my investment in HDFC Bank. The first was Covid pandemic. Me and my wife were fortunate to keep our jobs during the pandemic and hence were able to save during those times. When markets across the world crashed I used the opportunity to top up my investment. The second was HDFC Bank’s merger with HDFC. Starting from Apr’22—when the announcement of HDFC Bank’s merger with HDFC was made—the stock started underperforming Nifty 50. I used the opportunity and aggressively increased my investment.

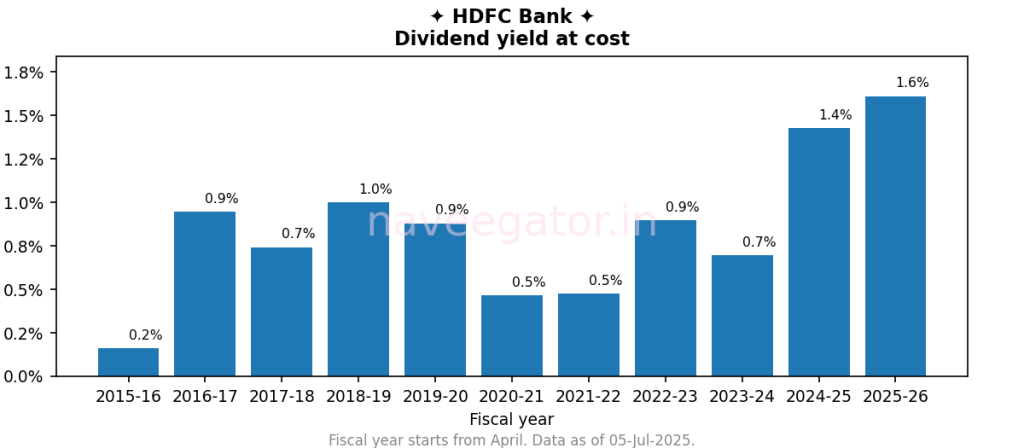

HDFC Bank has now slowly recovered and at an XIRR of 13.8% (Figure 2) it is marginally below Nifty 50’s 15.4%. Keeping fingers crossed that it beats the Nifty 50 index in the coming years. The dividend yield at cost (Figure 3) at 1.6% is also not bad.

One key lesson I learned during the years was that you need confidence along with a dash of ignorance to make investments in equity. Without ignorance you consume too much information and never make any investments either out of fear or waiting for the right opportunity. How many times have you read the below headline?

<Company name> has a strong <buy/sell> recommendation and an <up/down>side with potential of more than <+/- some number between 10 and 50>.

I have read it. Every. Single. Day. I learnt to ignore this noise.

Final thoughts—While I can theoretically say that I have a long term investor, little more than 91% of my investment came in the last five years (Figure 1). I still have a long way to go.

You must be logged in to post a comment.