My investment in Franklin India Prima Fund continues in the sixth year. Along with the fund house renaming it from Franklin India Prima Fund and me stopping my SIP in Jan’25 there were no other significant events that happened since last one year. I plan to continue to hold this fund for long term and will restart my SIPs once my current financial commitments are taken care of.

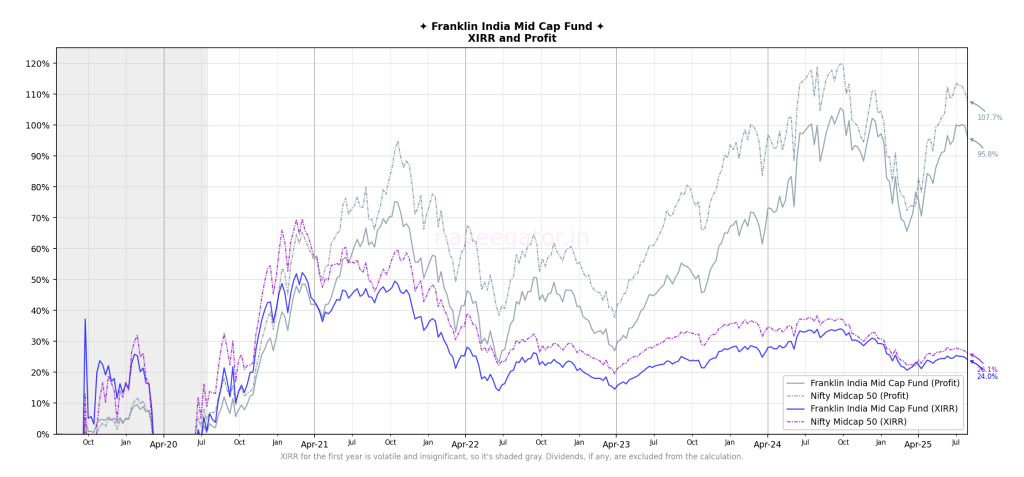

Franklin India Mid Cap Fund continues to underperform Nifty Midcap 50 although over the last 1½ years the gap has reduced a bit (Figure 2). The Trump tariffs are very much visible in the Figure 2. A steep drop in profit starting from Jan’25 and then recovery starting from Mar’25.

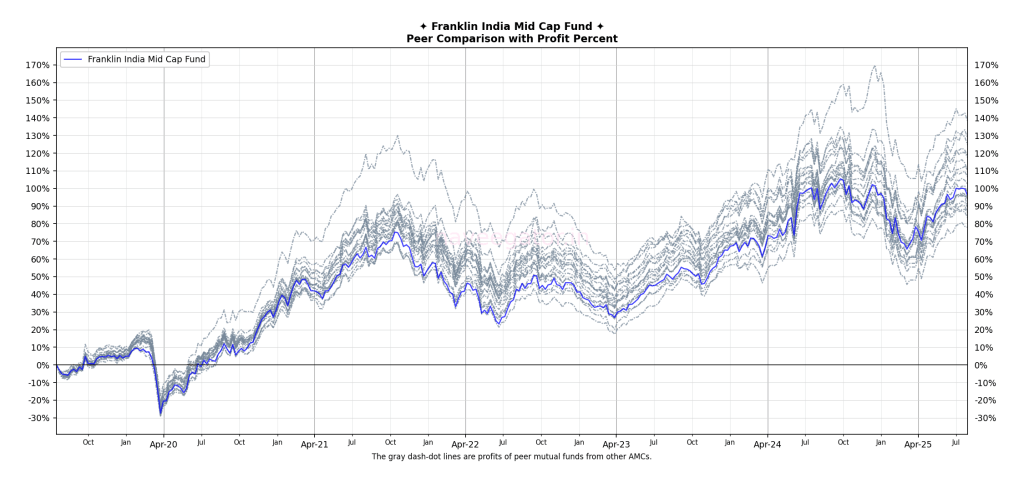

How does Franklin India Mid Cap stack up against its competitors?

I analysed CRISIL’s Mutual Fund Ranking and compared my returns to each of the mid cap mutual funds. Here’s how I conducted my calculations.

- I included only those funds that were established before my first investment in the Franklin India Mid Cap. Therefore, you won’t find ITI Mid Cap Fund in the list, as it was launched after my first investment in the Franklin India Mid Cap.

- For the competitor funds, I used the same investment amounts and dates as those for my investment in Franklin India Mid Cap. This approach allowed me to answer the question, “What if I had invested in ABC Midcap Fund?”

Table 1 below illustrates the profit percentages I would have earned from the Franklin India Mid Cap and its competitors. It’s clear that I would have been significantly better off investing in the Motilal Oswal Midcap Fund.

| Mutual Fund | Profit (as of Aug’25) |

|---|---|

| Motilal Oswal Midcap Fund | 138.1% |

| Invesco India Mid Cap Fund | 128.4% |

| Edelweiss Mid Cap Fund | 124.5% |

| HDFC Mid Cap Fund | 118.5% |

| Nippon India Growth Mid Cap Fund | 117.5% |

| Kotak Midcap Fund | 110.6% |

| Mahindra Manulife Mid Cap Fund | 109.6% |

| ICICI Prudential MidCap Fund | 106.3% |

| Sundaram Mid Cap Fund | 102.2% |

| HSBC Mid Cap Fund | 97.1% |

| Franklin India Mid Cap | 95.8% |

| Tata Mid Cap Fund | 95.1% |

| Baroda BNP Paribas Mid Cap Fund | 94.0% |

| PGIM India Midcap Fund | 93.9% |

| Aditya Birla Sun Life Midcap Fund | 89.4% |

| SBI Midcap Fund | 89.3% |

| LIC MF Midcap Fund | 86.4% |

| Axis Midcap Fund | 86.3% |

| UTI Mid Cap Fund | 83.3% |

| DSP Midcap Fund | 77.9% |

And if you look at Figure 3, you will see that Franklin India Mid Cap Fund has slowly and steadily increased its performance vis-à-vis its competitors.

You can also get a better sense of the journey each mutual fund has taken over the past six years with the below bar race chart. It shows all the mid cap mutual funds from Table 1 and their performance over last six years. The bar race chart was created using Flourish, you can view the Flourish hosted version along with data over here.

A couple of observations from the above bar race chart.

- The first 1½ year—from Jul’19 to Dec’20—is very volatile. And that period also includes the Covid market crash. It is only after Jan’21 you start to see stable returns.

- PGIM India Midcap Fund starts off very impressive. And then—kind of—falls off the cliff from Jun’23.

- While Motial Oswal Midcap Fund is the topmost fund today (Table 1), it wasn’t always the case. Before Aug’21 it was in the last place. Motial Oswal Midcap Fund moved dramatically from last place to the top from Aug’21 to Sep’23. And as of Aug’25 it is still there.

- Over the six years, Franklin India Mid Cap Fund has moved from last place to the middle of the rankings. Slow, but steady.

Final thoughts

While XIRR of 24% for Franklin India Mid Cap Fund looks impressive, comparing it to its competitors gives another picture. But choosing the best fund is near impossible because every year there’s a new one. I don’t know if there’s a strategy to choose the best mid cap fund, but sticking to Franklin India Mid Cap for the near future is something that I would be following.

You must be logged in to post a comment.