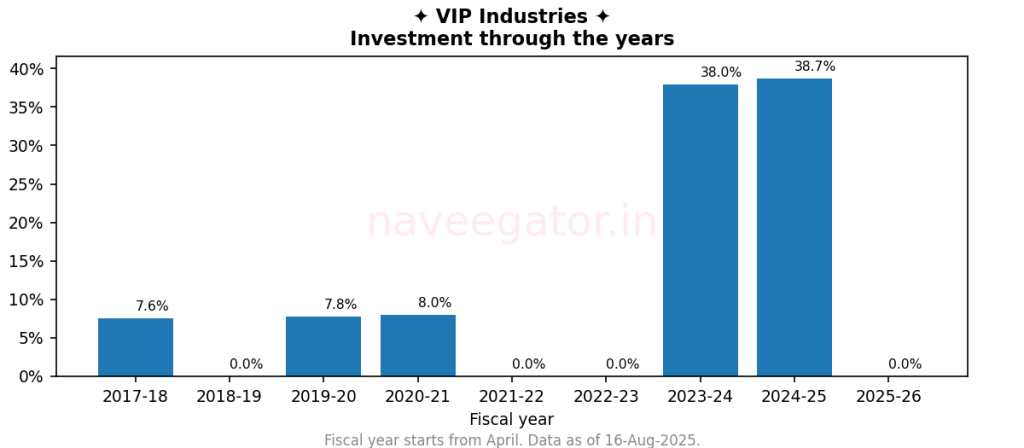

Eight years ago, when I first invested in VIP Industries, I had no idea what kind of journey I was starting on. My investment was scattered through these eight years (Figure 1) and it was more of a diversification mechanism rather than investment backed by research. I have bought VIP suitcases and bags. They turned out to be good. So the stock must also be good.

Although VIP Industries represents less than 2% of my direct equity portfolio—even less if I consider my mutual funds—it has taught me valuable lessons about investing in equities.

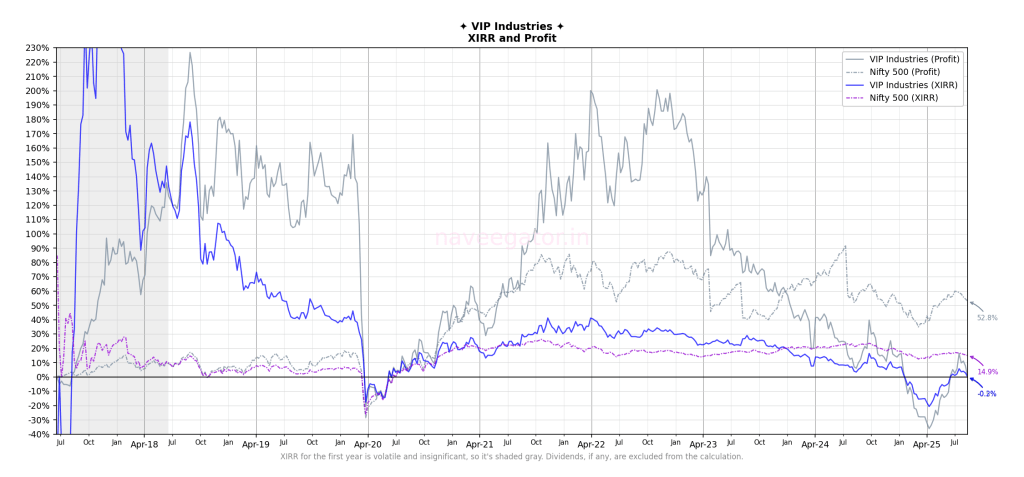

First, volatility. We have all heard countless times that stocks are volatile, but nothing prepared me for how true that would be with VIP Industries during the Covid pandemic. In just one month, my investment went from a 170% profit to a 20% loss (Figure 2).

Second, beginner’s luck versus long term reality. When you start investing, you often experience beginner’s luck, where your investments outperform your expectations. VIP Industries was one such stock, delivering impressive returns for the first 2½ years. Even the post Covid recovery was remarkable, with an XIRR of 40%. But then, reality set in—a reality where a former Managing Director left VIP Industries to a primary competitor, causing a shift in the industry.

My investment in VIP Industries currently stands at -0.2% XIRR compared to 14.9% XIRR for Nifty 500 (Figure 2).

Finally, the dividend yield at cost (Figure 3), which had been hovering above 1% till 2022, has come crashing down to 0.3%.

With the current geopolitical climate I know that the pain will continue. I just don’t know for how long.

You must be logged in to post a comment.