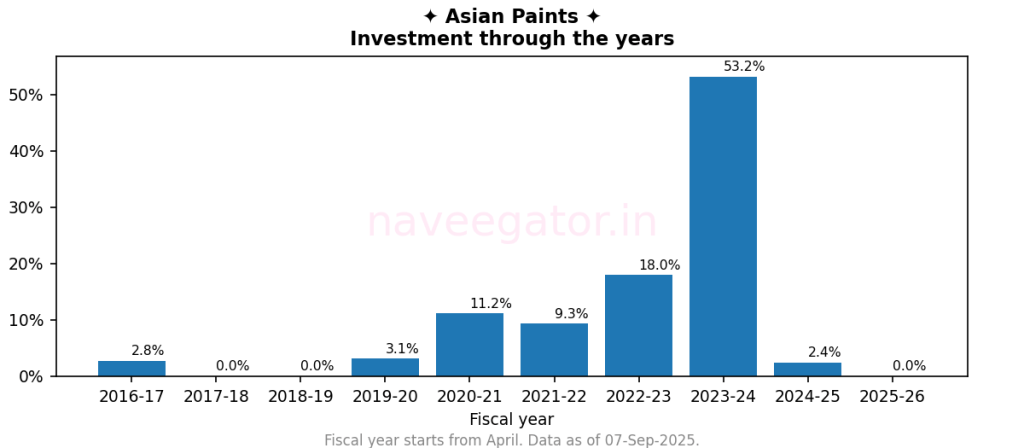

I am only one year shy of completing ten years with my investment in Asian Paints. But don’t let the number of years fool you into thinking that I am a long term investor. More than half of my investment has come in FY 2023-24 (Figure 1). During the initial years—when the company was going strong and I should have been investing aggressively in it—I was looking the other way and trying to diversify. It was only when effect of Grasim’s entry into paint industry started becoming evident and the Asian Paints’ share price corrected, I made aggressive investments.

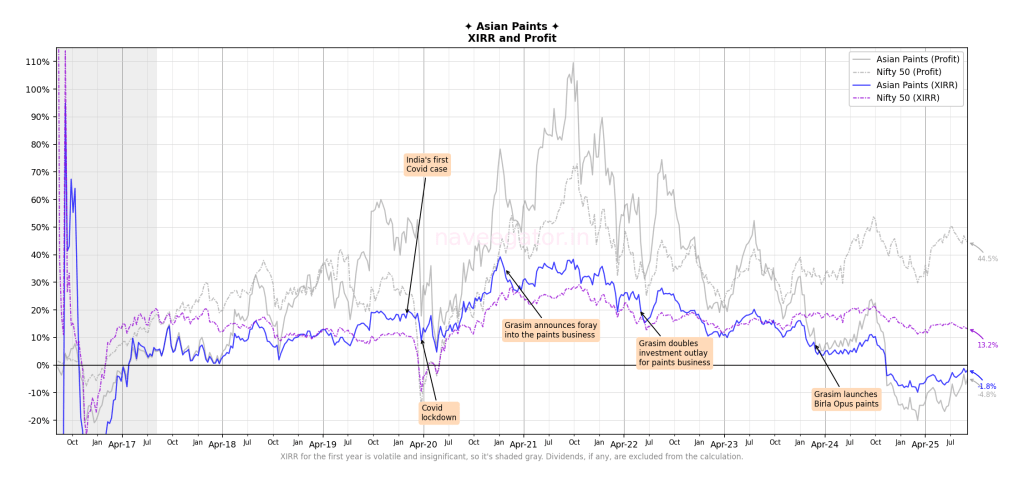

Hence, due to significant weight of my recency in investments, my XIRR have come down in the past two years (Figure 2). I enjoyed a significant outperformance vis-à-vis Nifty 50 for the first seven years. After that it has been all downhill. And in Nov’24 my XIRR went negative—something I did not see even during the Covid times.

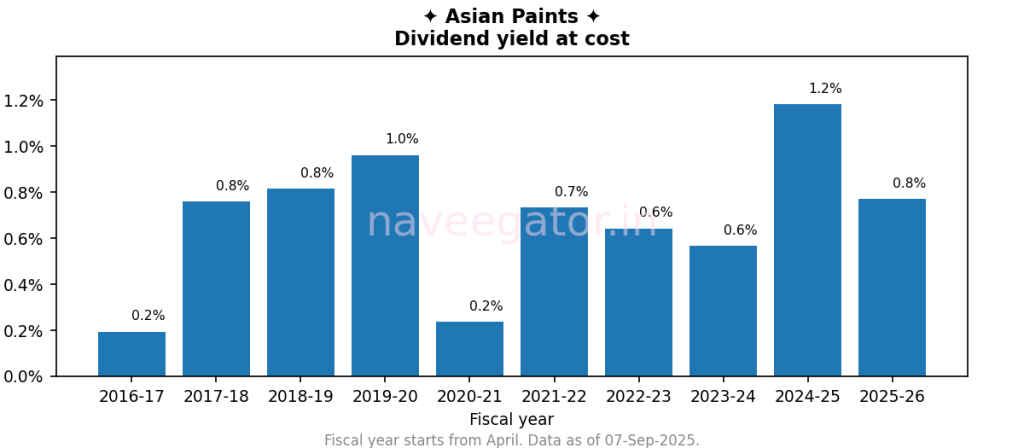

Grasim’s entry has not only affected Asian Paints’ share price but also the dividend yield which dropped significantly from FY 2024-25 to FY 2025-26 (Figure 3).

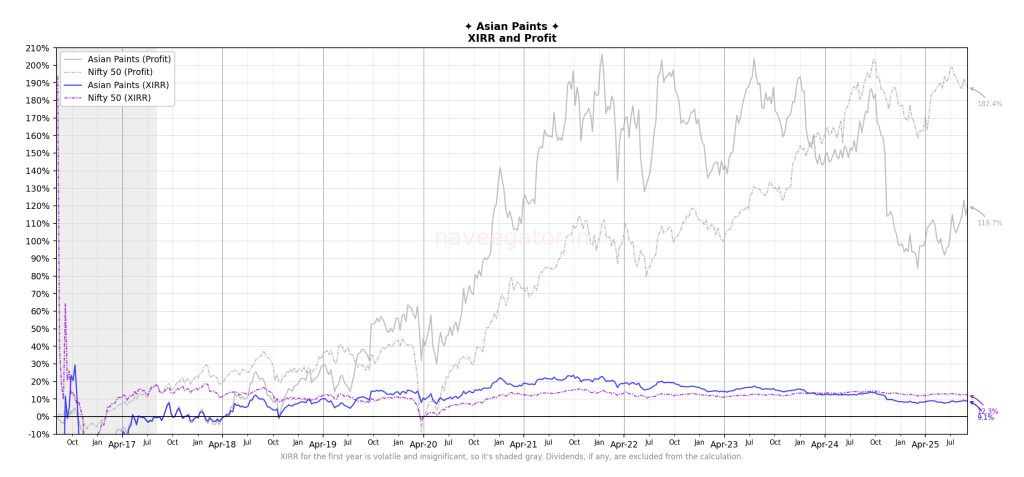

What if…

…I had made all my investments in Asian Paints in the first year itself i.e. FY 2016-17. Something I wondered while writing this post. So I put this thought into action and got the below chart (Figure 4). The results are much better but the pain would still have been there. At 9.1% XIRR I would still have underperformed Nifty 50. But the real pain would have come from the steep drop in profit which would tumble from 200% to 100%.

This simply goes on to show over long term I cannot be sure what will happen. Even the best companies will tumble and it may coincide with the time when I am planning to exit. I cannot simply say “I will put money in a company, wait for 15 years, and then take out my money at 15% XIRR”. That’s not going to work.

I plan to continue to hold Asian Paints for now. But I will have a better strategy when the time nears for exiting.

You must be logged in to post a comment.