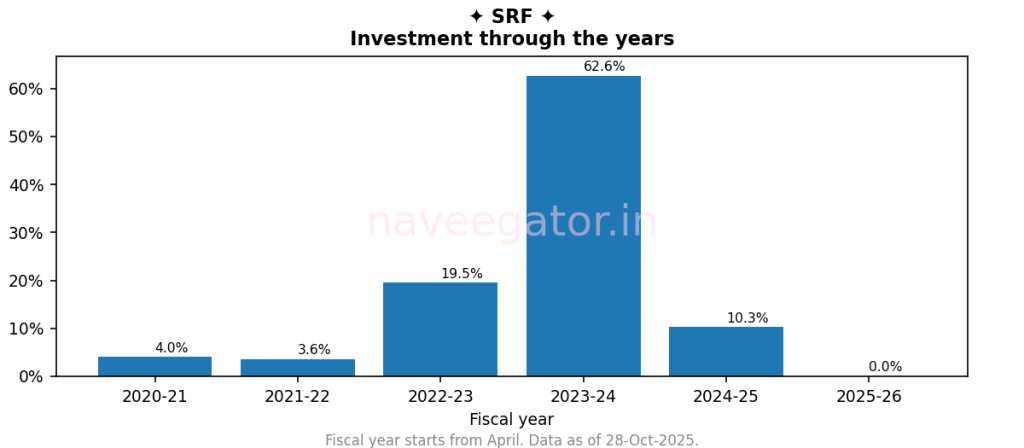

While I have completed five years with my investment in SRF, the investments themselves has been very uneven. For example, my investments in FY 2023-24 alone account for more than 60% of my total investments (Figure 1). Hence, I am still early in my investment journey.

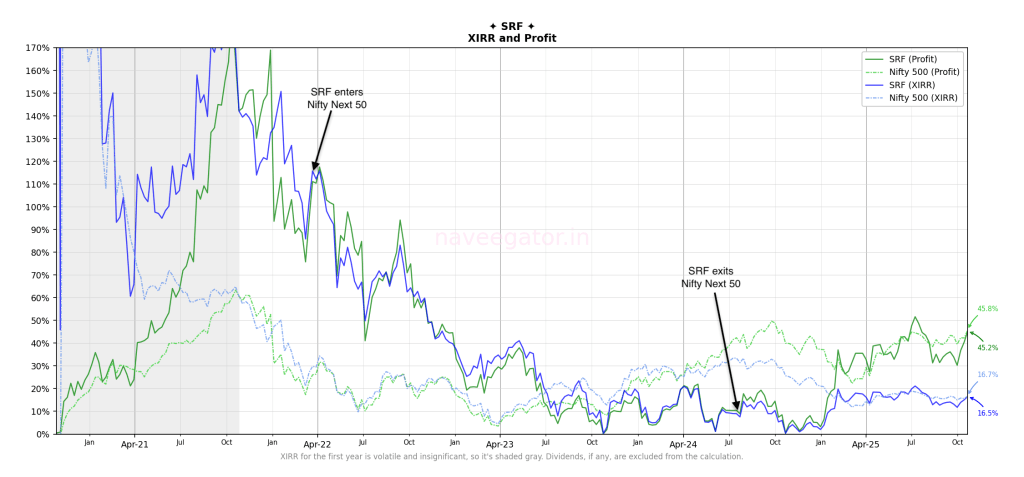

Now coming to the returns. The initial years were great (Figure 2). But then slowly reality kicked in. SRF started underperforming Nifty 500 from Sep’23 and it lasted almost 1½ years till Feb’25. Now SRF has recovered and is evenly matched against Nifty 500. But SRF’s inclusion in Nifty Next 50 index had no meaningful impact on its performance. SRF now is no longer part of the Nifty Next 50 index.

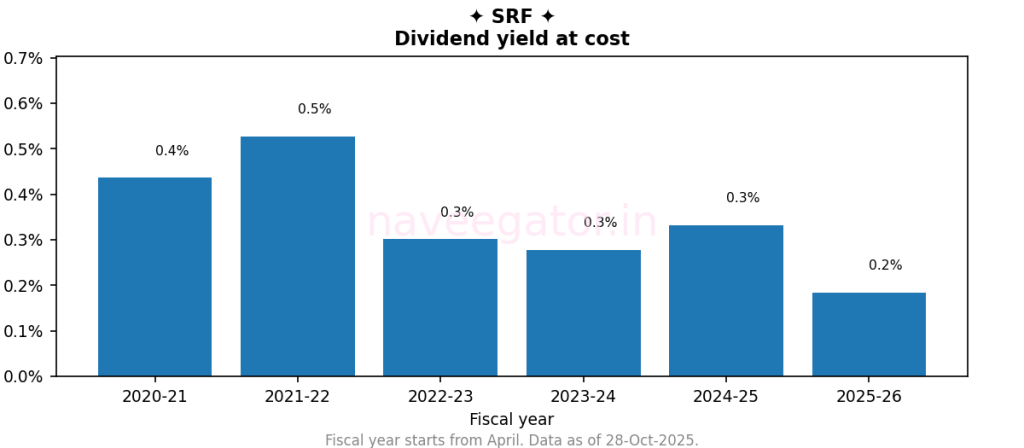

On dividends front (Figure 3), well, it has been extremely miniscule. At 0.2% dividend yield at cost, this is probably the lowest dividend generating company that I own in my portfolio. But hey, at least I am now matching the Nifty 500 index.

You must be logged in to post a comment.