In the early days of my equity investment journey, I was looking for companies to invest in by focusing on those whose products I used. These companies—for me—were familiar, established, and likely to have been in business for a while. More importantly, they will also be in business in the future. That’s how Colgate landed in my portfolio.

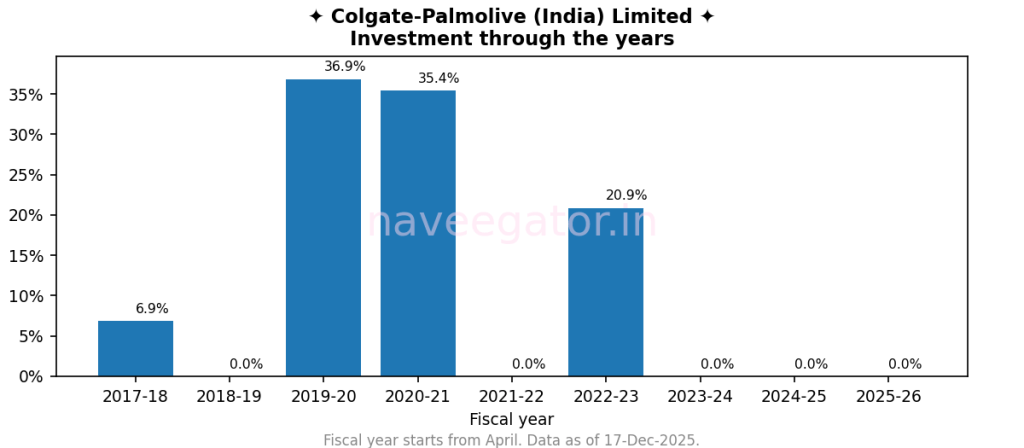

My investments have not been very consistent in Colgate. Some years I have invested significantly, and in others zero (Figure 1). But since FY 2022-23 there has been a complete pause in my investment.

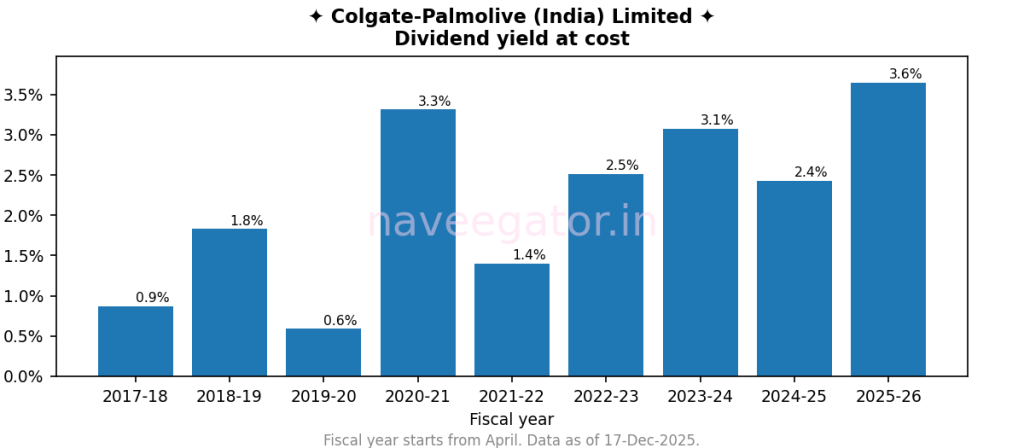

From the perspective of dividends, Colgate has one of the highest dividend yield at cost for me (Figure 2). For FY 2025-26 the dividend yield at cost stood at 3.6%. I would say that’s pretty good.

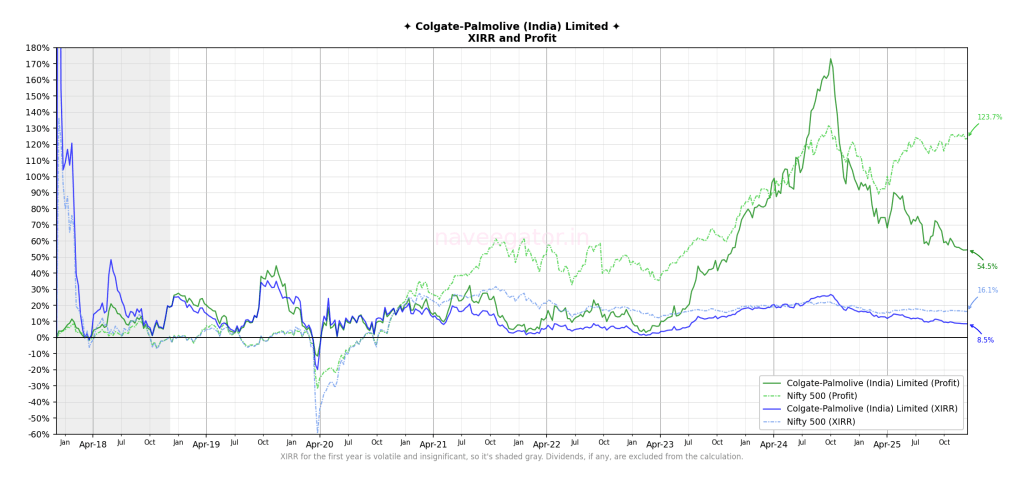

What’s not good are the returns (Figure 3). For a brief moment in Oct’24 my returns were sky high with nearly 180% profit. But then as quickly as it went up, it all came crashing down. And it seems there’s nothing stopping the fall. From the peak of 27% XIRR, I am now at 8.5%. And to top that, Colgate was pushed out of Nifty Next 50 in Sep’24.

If I compare Colgate against host of other indices the picture still remains bleak. My investment is the lowest performing one. And I think the pain is not going away anytime soon.

You must be logged in to post a comment.