My journey with Aditya Birla Sun Life MNC Fund completes four years and continues in its fifth year. Nothing much has happened here except that I have now paused my SIP in the fund considering its underperformance.

Is this a regular or a direct plan? It’s both. I started with a regular plan with help of MFD and then from Sep-2020 I started investing in the direct plan as well. The charts below are for both of them combined. My investment is equally split between the regular and direct plan.

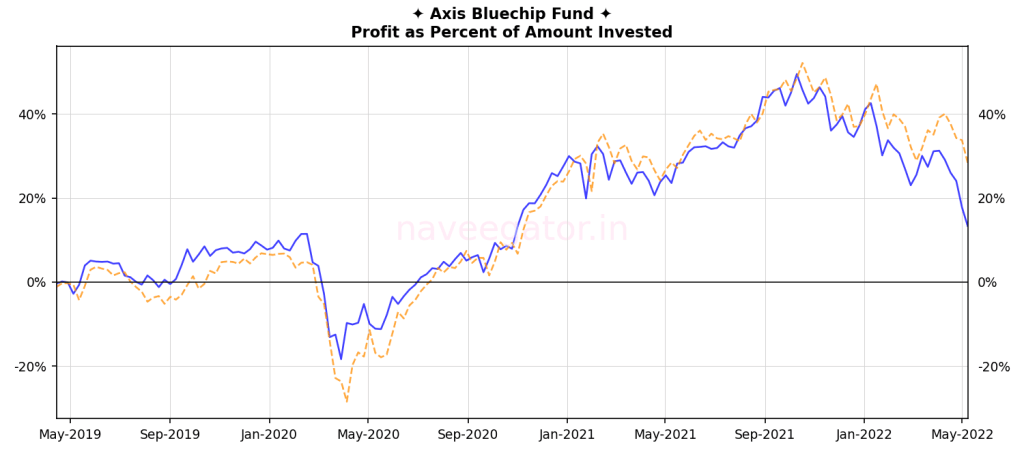

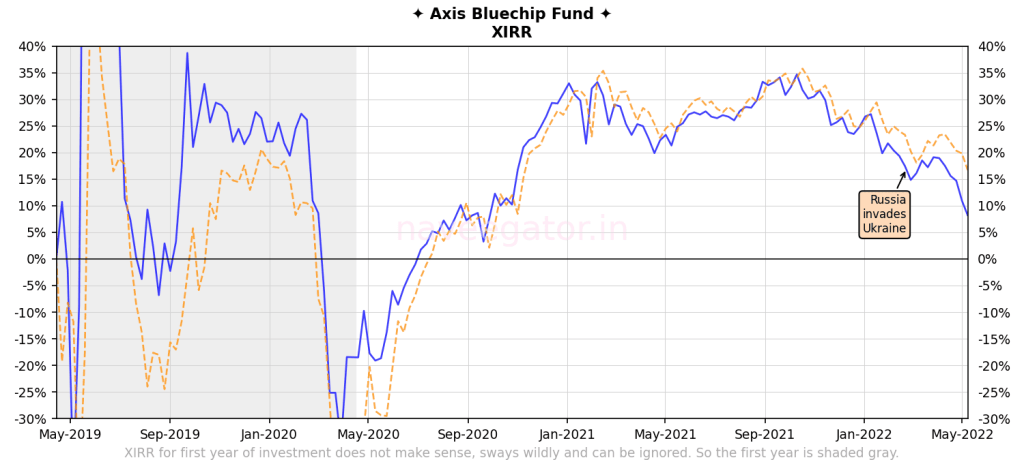

Did I beat the Nifty 50 Index? No. Since last two and half years, my investment has underperformed the Nifty 50 Index.

Did I at least beat other similar thematic funds? No. As this was a thematic fund I decided to compare with other funds in the same category. For this I chose SBI Global Magnum Fund. I wanted to understand if the underperformance was across all the funds in the category. But my investment has underperformed even SBI Magnum Global Fund. In fact, SBI Magnum Global Fund managed to beat the Nifty 50 Index.

Am I going to continue investing in it? No, my SIP is paused.

Considering my SIP is paused am I planning to redeem my investment? Yes, but not right away. I am hoping that someday—someday—it beats Nifty 50 Index or at least comes up with XIRR of 12% for me to sell.

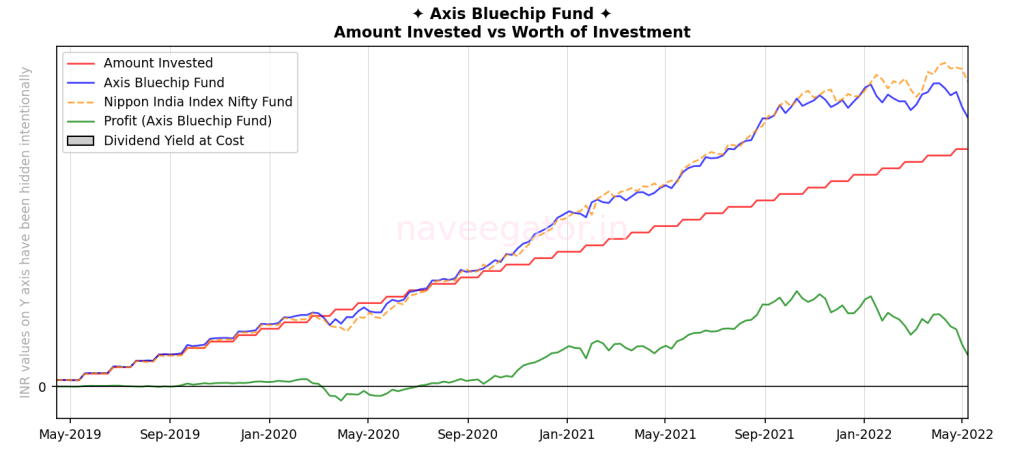

Investment through the years

Returns

Profit

XIRR

You must be logged in to post a comment.