My second year with Weekend Investing’s Mi_NNF10 Momentum smallcase was going okish, until a report from Hindenburg Research—accusing Adani Group of brazen stock manipulation and accounting fraud—burned everything.

Hindenburg report

Mi_NNF10 smallcase had invested in couple of Adani Group companies from Nifty Next 50 index. Once the Hindenburg report was released there was a massive sell off in Adani Group companies. In a single day, two years worth of my (unrealised) profits were wiped clean and I was in red. I initially thought of exiting only Adani stocks, but decided against it and went with fund manager’s monthly rebalance.

The lower circuit

When it was time to do monthly rebalance, I could see that all the Adani stocks were being sold off. I hit the Confirm Update button on the smallcase portal but one of Adani Group company stock hit the lower circuit and I could not sell it. I had to repair my smallcase; a first for me in 2 years. But it kept hitting lower circuit I lost 70%. Ouch!

My learnings

While smallcase simplifies direct equity investment with a fund manager’s guidance there are certain caveats that I learned along the way.

1. Taxes

With every rebalance you will be selling some or the other stock. And with that you will be hopefully making some long or short term capital gain; mostly it will be short term capital gain. And that is taxed at 10% or 15%. But you won’t pay that right away. It will magically show up while filing your tax returns. When I was filling my tax return I could see a bunch of capital gains that were getting taxed but it was really difficult for me to analyse if they were from the smallcase or my own trades. And if you have more than one smallcase then… well you get the idea. In essence, calculating impact of taxes on your smallcase is very difficult, if not impossible.

In contrast, calculating impact of taxes on your mutual fund redemptions is fairly straightforward.

2. Lower circuit

If any of your stock in smallcase hits lower circuit when it’s time for rebalance and you need to sell, then you are f…, I mean you are at gods mercy. This is what happened to me and I had thought it will never happen to me. You see, I chose Mi_NNF10 for a reason; it only invests in Nifty Next 50 companies. What could go wrong, right? Wrong! One of the Adani Group companies went into lower circuit and by the time I was able to sell it, I lost 70% on that investment. Ouch!

3. Comparison to benchmark

Since there is no NAV for the smallcase you cannot compare it to any benchmark. There is chart on the smallcase homepage that shows its performance against equity large cap, but that does not consider impact of fund manager’s fees, LTCG, STCG, and events like lower circuit hampering your rebalances. I can be making 20% XIRR but I cannot compare it to any index say Nifty 50 Index. Had I invested the same money in Nifty 50 Index would I have made better returns? I can never answer this question.

Unsolicited tip for smallcase folks: Show historical performance of smallcase for each individual.

4. Expense ratio

If you want to get full benefit of your smallcase then you need to look into expense ratio. If your expense ratio is more than 5% then its not worth it. IMHO, it should be in the range of 1-2%; similar to that of mutual funds. And this expense ratio has to be managed by you. Unlike mutual funds, where it does not matter how much you invest—five hundred or five lakhs—the expense ratio remains the same.

One good side effect of managing the expense ratio was that, with dividends earned I was able to recoup my subscription fees in its entirety for both years.

And yes, the fund manager started a scheme offering discounts to subscribers who had been with smallcase for more than two years reducing my expense ratio for this year. Yay!

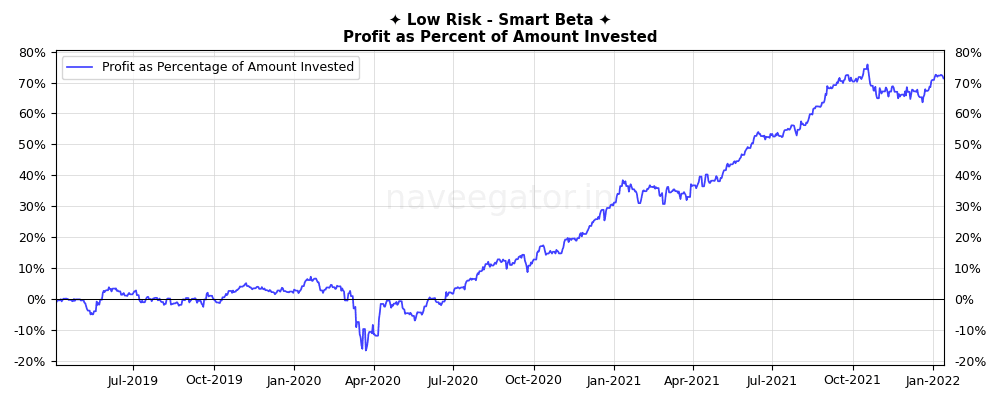

Return

Calculation of Amount Invested

- Subscription fee for smallcase

- Being fee for smallcase

- Amount paid while rebalancing

- DP charges that I incur while selling stocks due to rebalancing

- Amount received while rebalancing (deducted from Amount Invested)

Profit Percent

Future

I am planning to continue in the smallcase for one more year.

You must be logged in to post a comment.