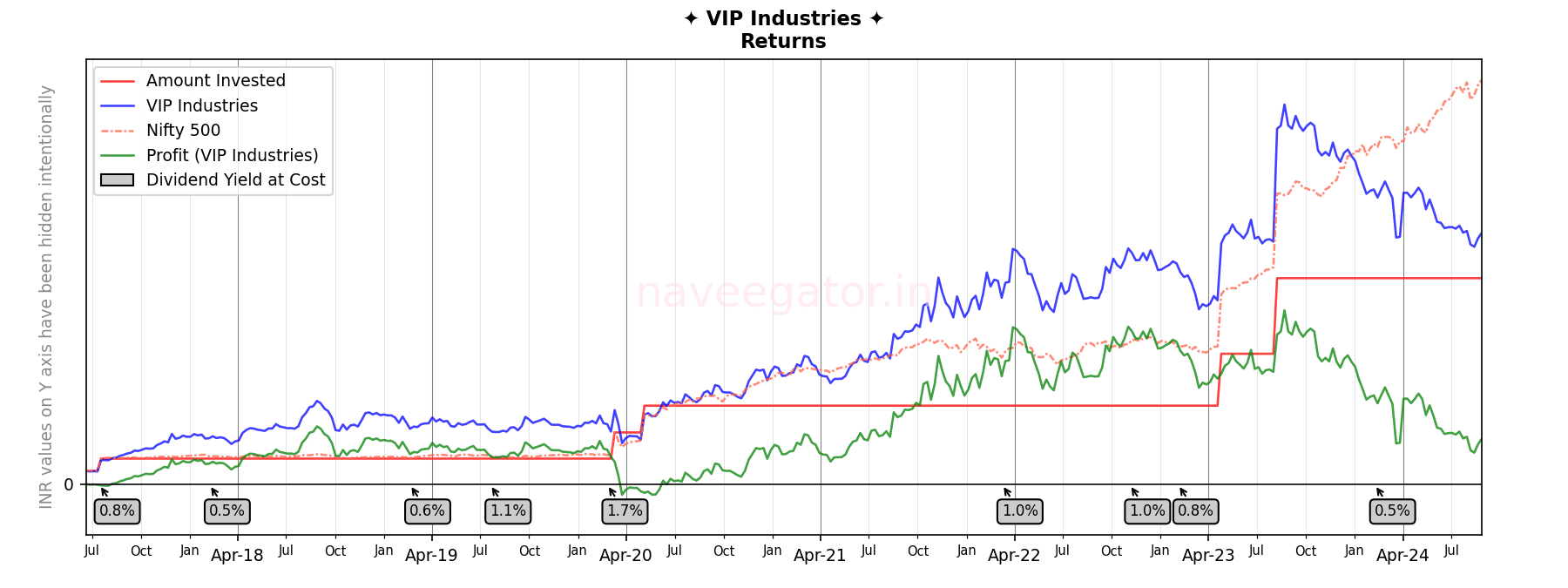

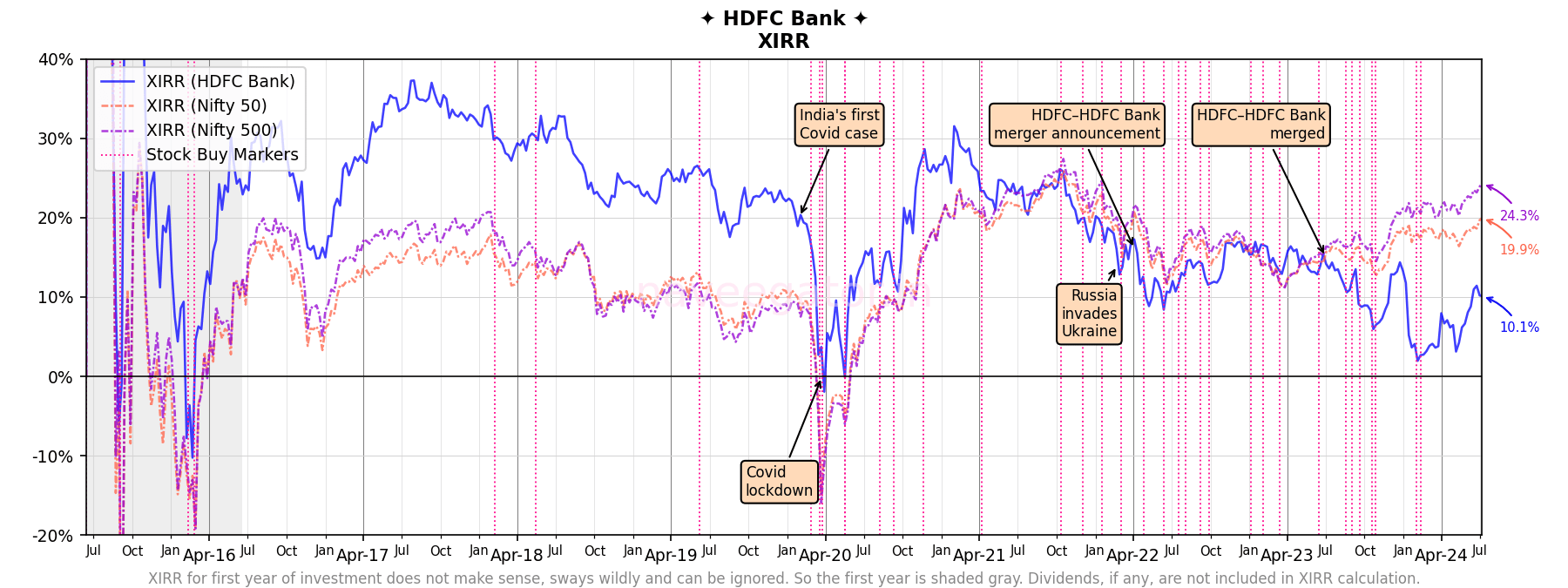

FY 2017-18

In the early days of my equity investment journey, I was looking for companies to invest in by focusing on those whose products I used. These companies—for me—were familiar, established, and likely to have been in business for a while. That’s how Colgate landed in my portfolio. The initial investment was not significant as I was dipping my toe in the water.

FY 2018-19

I did not make any investments in Colgate this year. But I did receive dividends on the small investment that I made in the previous year. The dividends—at cost—were impressive, at least impressive than the puny dividends from other companies which never crossed 0.5%.

FY 2019-20

If I wanted to earn more dividends, I had to invest more—that was my logic. So, I increased my investment in Colgate, and it paid off. At one point, my XIRR was soaring above 30%. But then, disaster struck—Covid.

FY 2020-21

The Covid lockdown caused markets to spiral downward. I—thankfully—was able to keep my job. This enabled me to continue my investment journey in Colgate. The recovery was pretty quick, and by the year-end the returns were decent, though they underperformed all major indices.

FY 2021-22

The underperformance from the previous year continued and by the year-end my XIRR was in single digits. I was getting fixed deposit returns. Moreover, I did not make any new investments.

FY 2022-23

The underperformance from the previous year again continued and by the end of the year my XIRR went down further. I wasn’t even beating fixed deposit returns this time around. Despite this, I still had some faith in Colgate and decided to make additional investments.

FY 2023-24

This was the resurgence year for Colgate—and for my patience in the stock. The stock moved up and so did my returns. My investment went from XIRR of 4% to 20% by year-end. I was beating most indices and matching some.

FY 2024-25 (on going)

The resurgence from the previous year continued. And for a fleeting moment my investment in Colgate was beating all the major indices. I was looking at an impressive 27% XIRR. And then FII sell off happened.

Remember that scene from Munna Bhai M.B.B.S. where Sunil Dutt finds out that Sanjay Dutt is not a doctor.

Bas Parvati bas! Umar beet jaati hai izzat kamane main. Aur tere bete ne…

बस पार्वती बस! उमर बीत जाती है इज़्ज़त कमाने मैं। और तेरे बेटे ने…

Those were my emotions. The decline was so sharp that—when plotted for profit percent—it appeared as a straight line.

And that’s how my journey has been so far. Hoping to stay invested for one more year and write again about this next year.