I started invest in SRF three years back, but it is only in this fiscal year that I have significantly increased my investment in SRF. This fiscal year alone I have invested more than 65% of my total investment. This makes my investment very young.

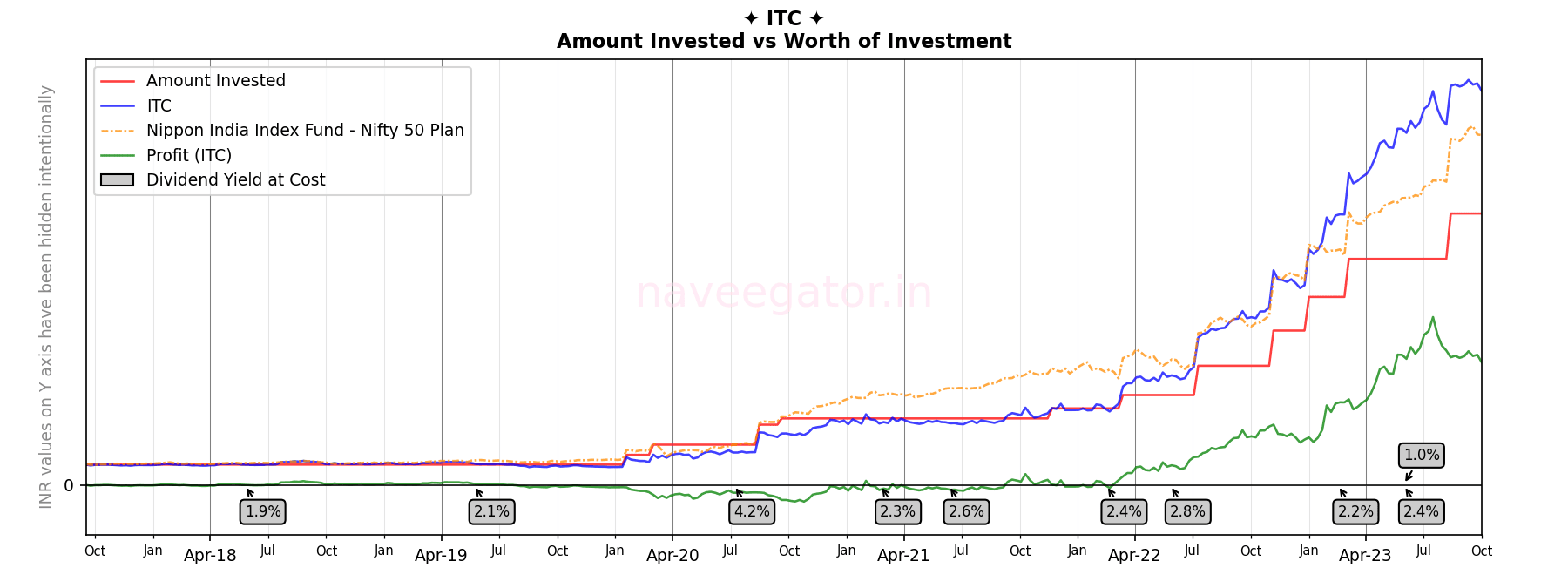

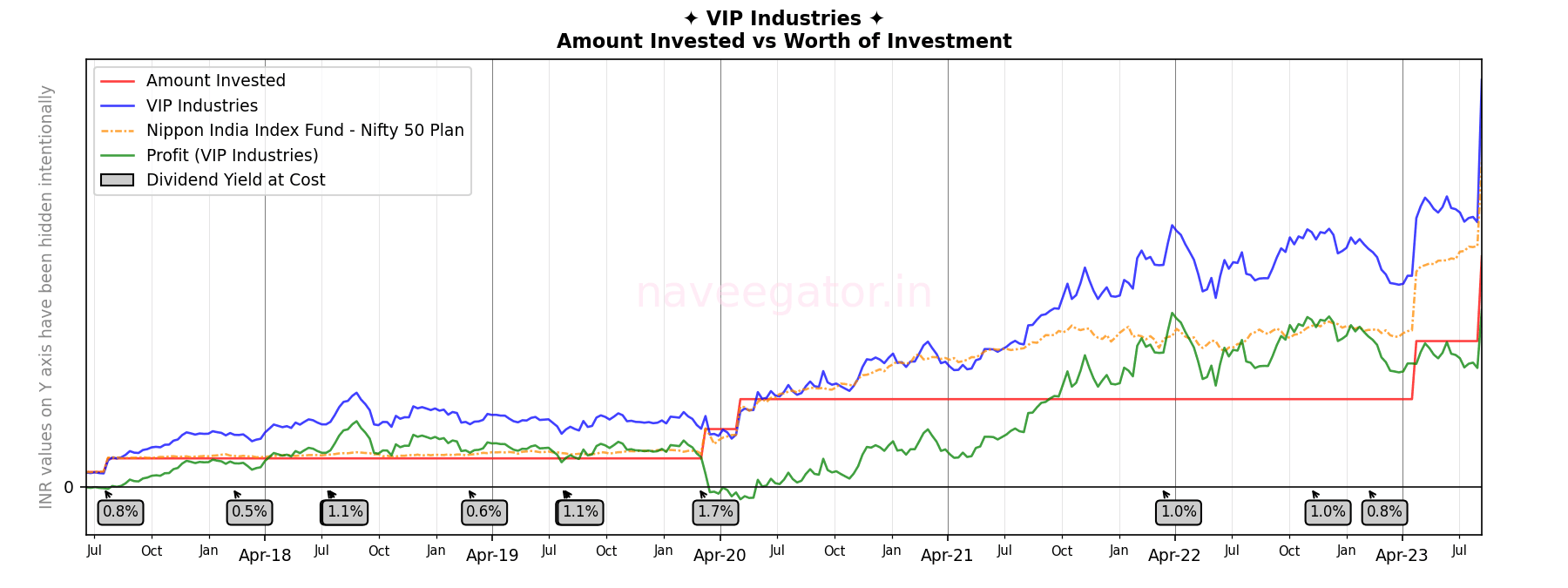

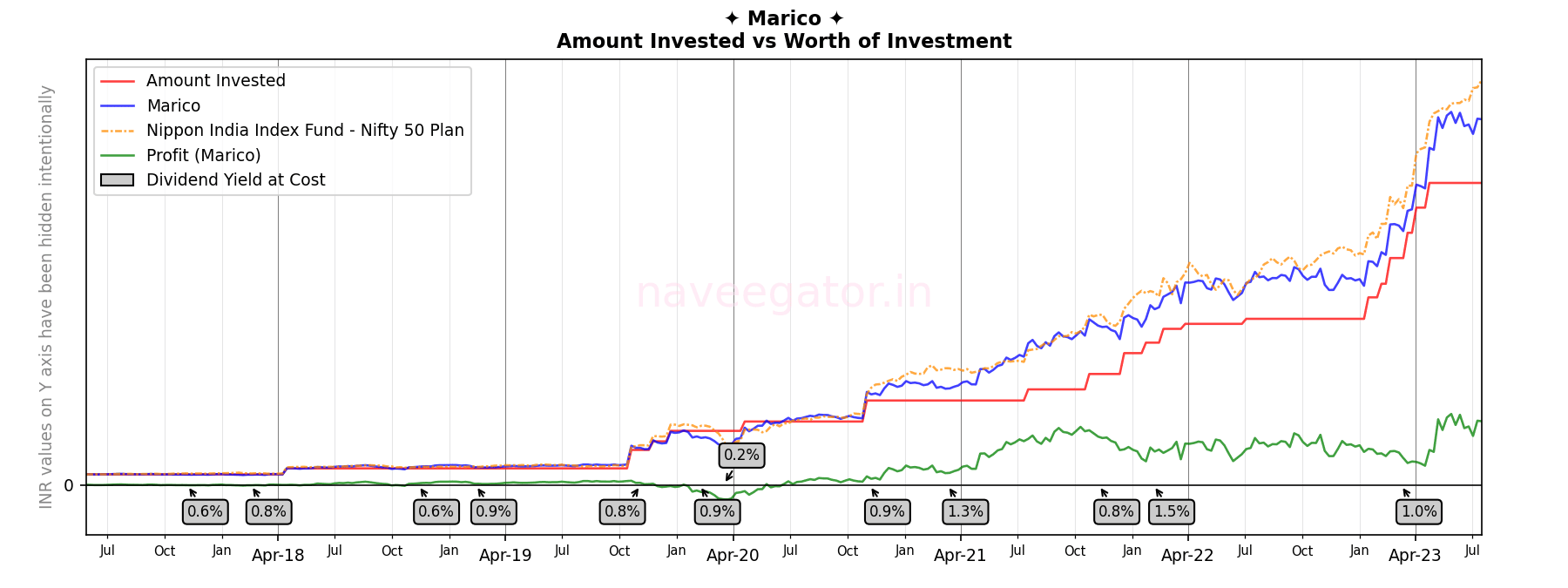

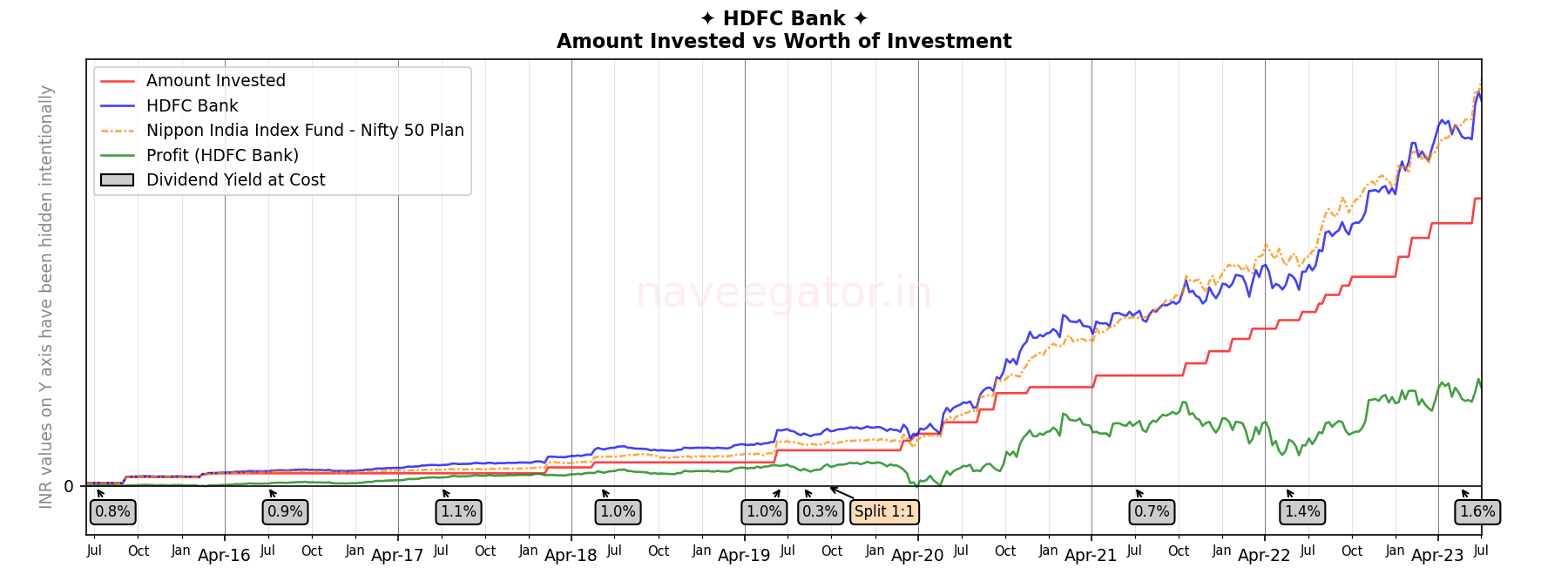

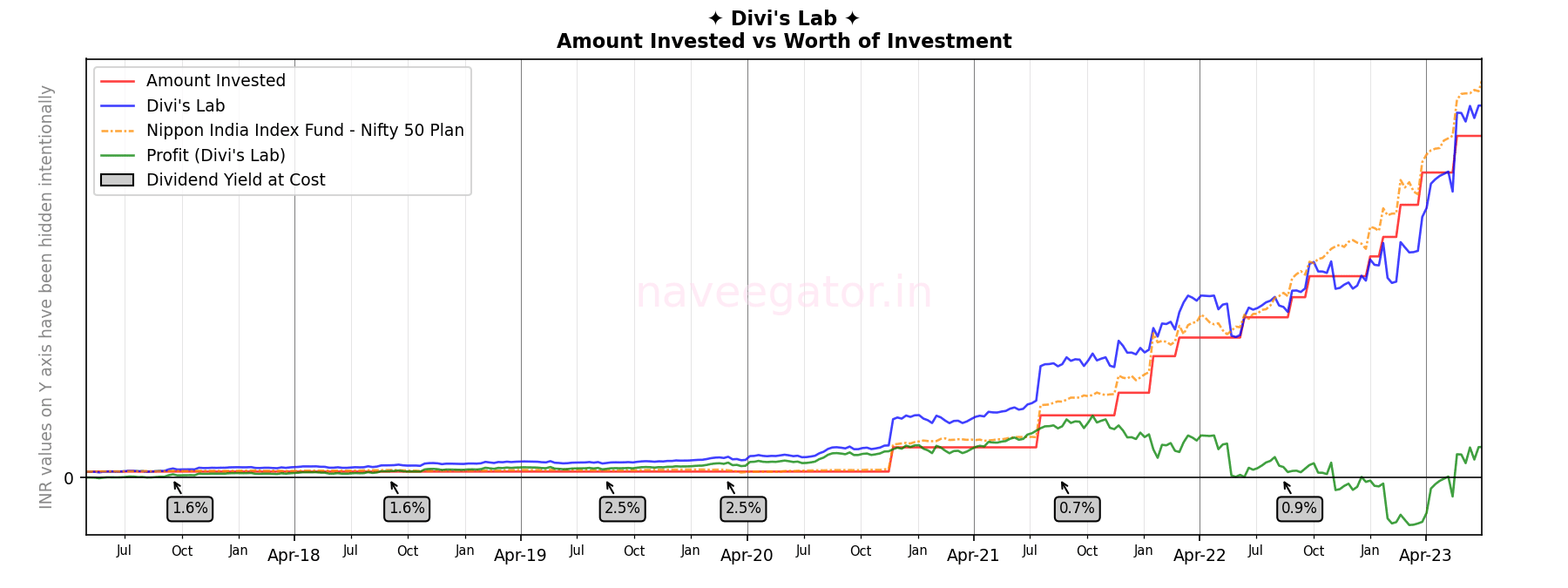

Investment through the years

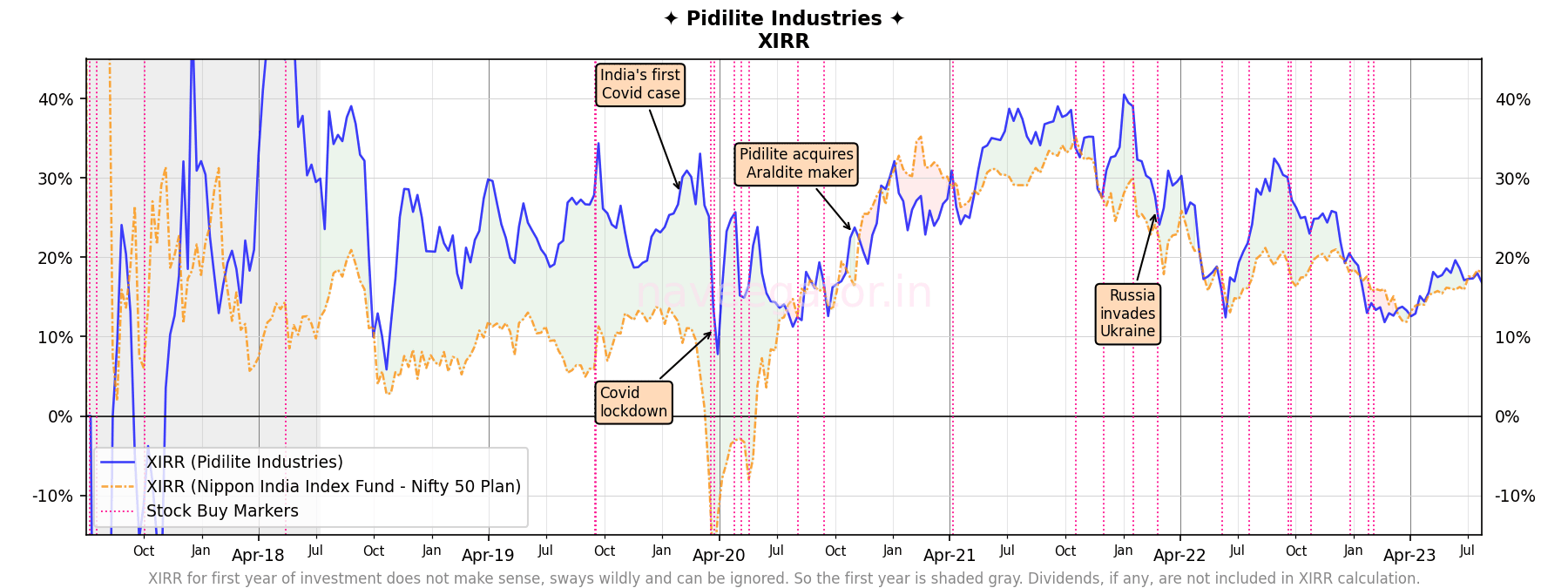

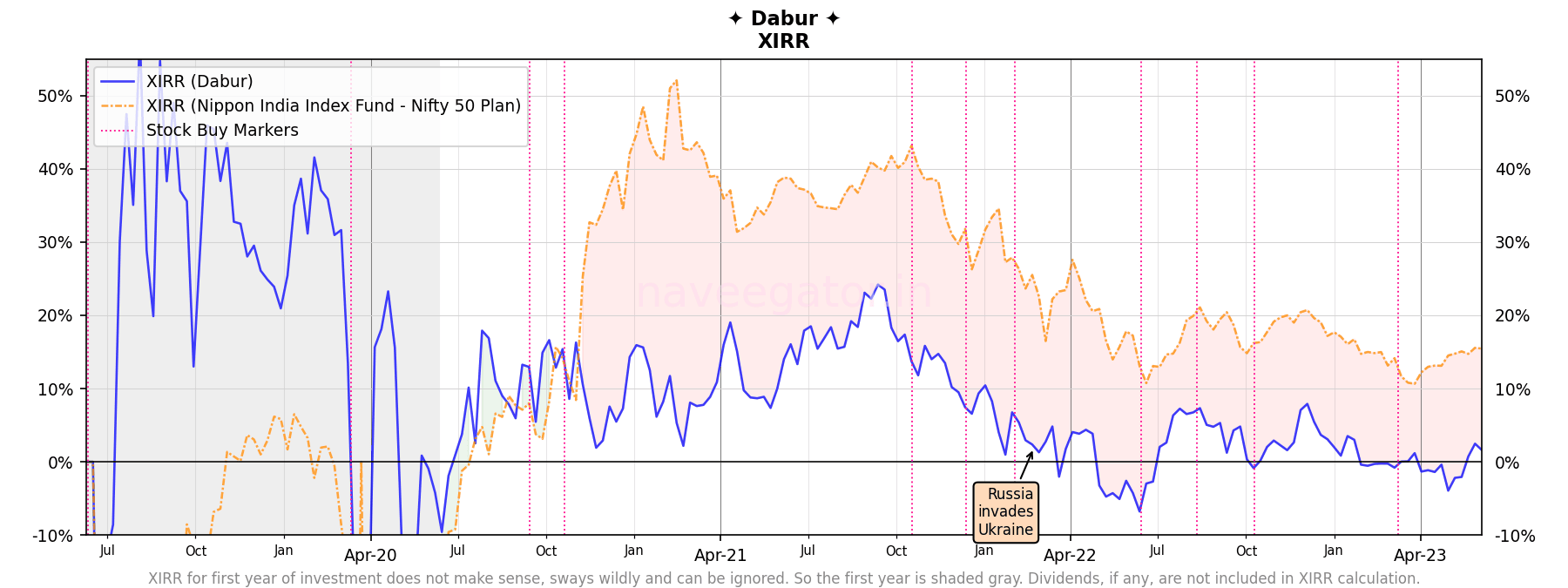

Returns

During the initial days my investment in SRF was comfortably beating Nifty 50 Index. But as I decided to increase my investment and SRF’s share price going sideways, I am now barely beating Nifty 50 Index. SRF generally announces dividends twice a year, but nothing to be talked about.

The dividend yield at cost mentioned in the chart above, is yield at the date at which I received the dividends. Another way to look at dividend yield is to calculate it for the fiscal year.

| Fiscal year | Dividend yield at cost |

| 2020-21 | 0.44% |

| 2021-22 | 0.53% |

| 2022-23 | 0.30% |

| 2023-24 | 0.13% * |

To calculate the dividend yield at cost in the above table I use the below formula.

(Total amount of dividends received in a fiscal year ÷ Total amount invested at the end of fiscal year) × 100

Profit

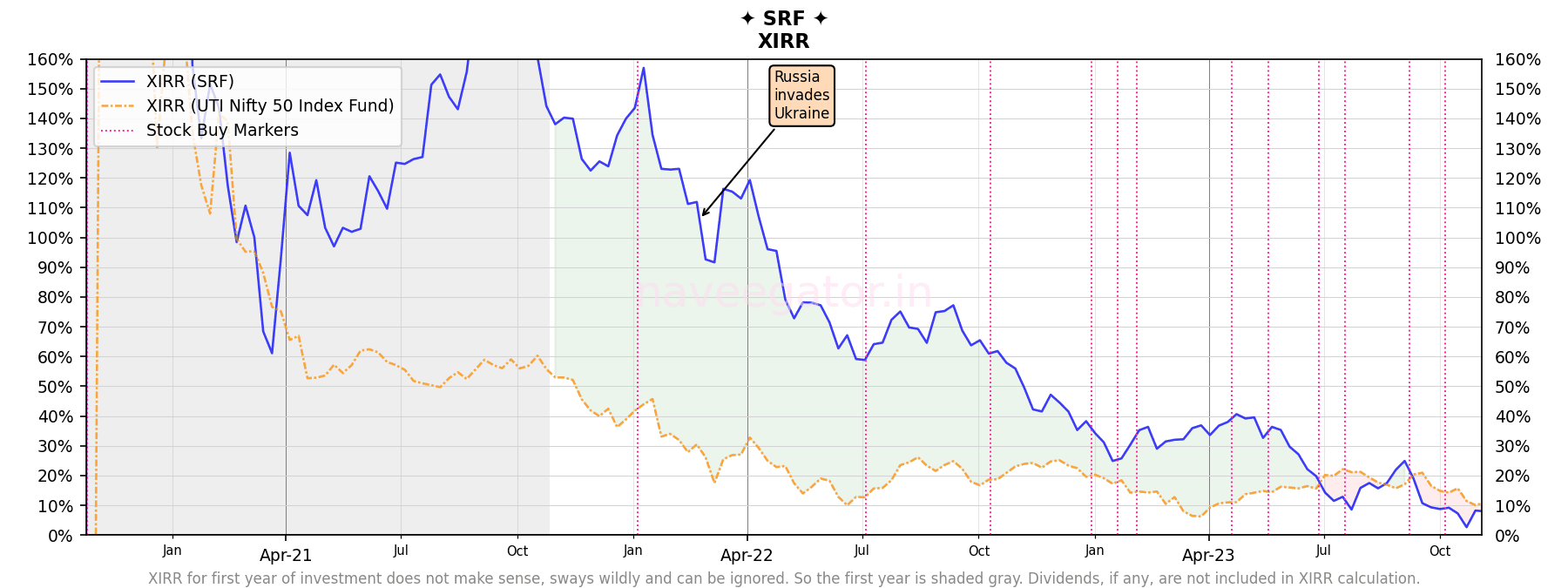

XIRR

At XIRR of 8%, I am underperforming Nifty 50 Index which would have been at 11%.