I have been incredibly lucky with my investment in Polycab till now. Till now. The keyword here is ’till now’. I don’t know what the future holds but if past is any indication—Divi’s Laboratories and L&T Infotech—I will probably make a big investment at peak, and the stock starts its downward trajectory erasing all my fantabulous gains.

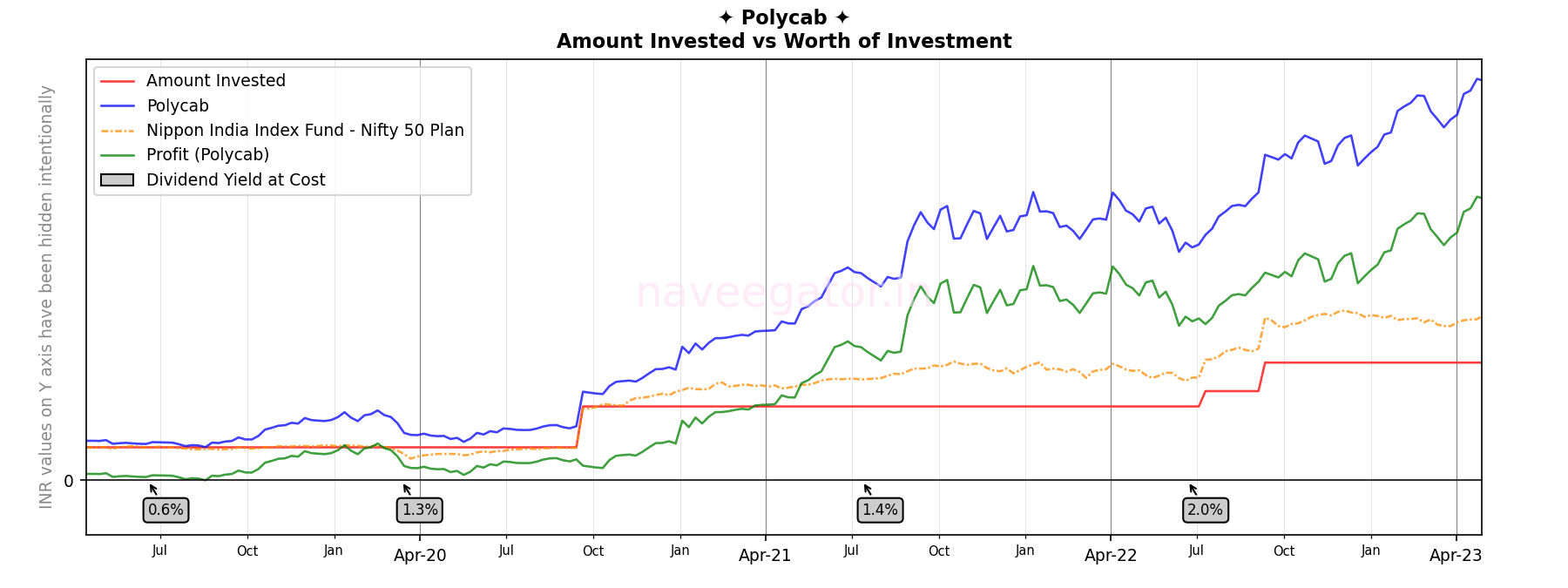

Polycab has been a star performer since last 4 years. Not only my returns have beaten Nifty 50 Index, my profits alone also have beaten Nifty 50 Index. The dividend yield at cost also has been above average, in my opinion. But while the returns are great but invested amount is small so it does not make enough impact in my portfolio.

Having a stock like Polycab is both boon and a bane. Boon because profits. Duh! Bane because I never have the courage to sell and book profits. What if it goes up even more? Every time I repeat to myself—I am a long term investor.

Let’s see what happens after five years. 🤞

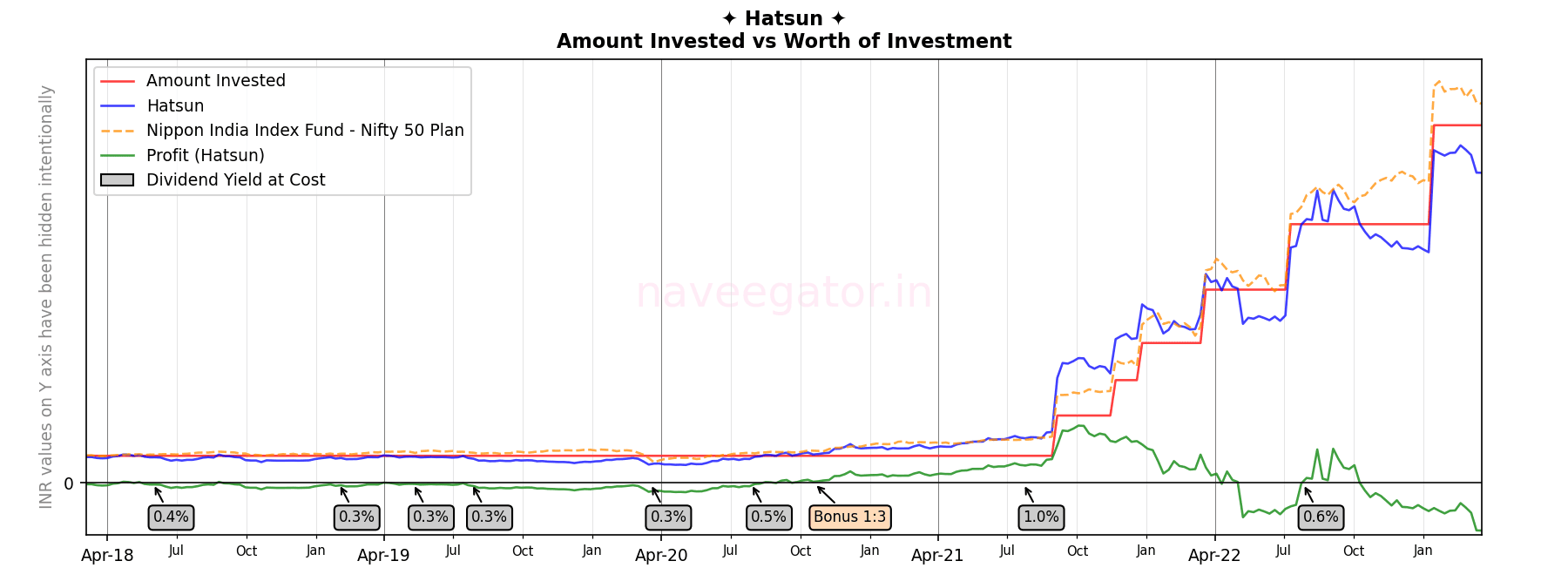

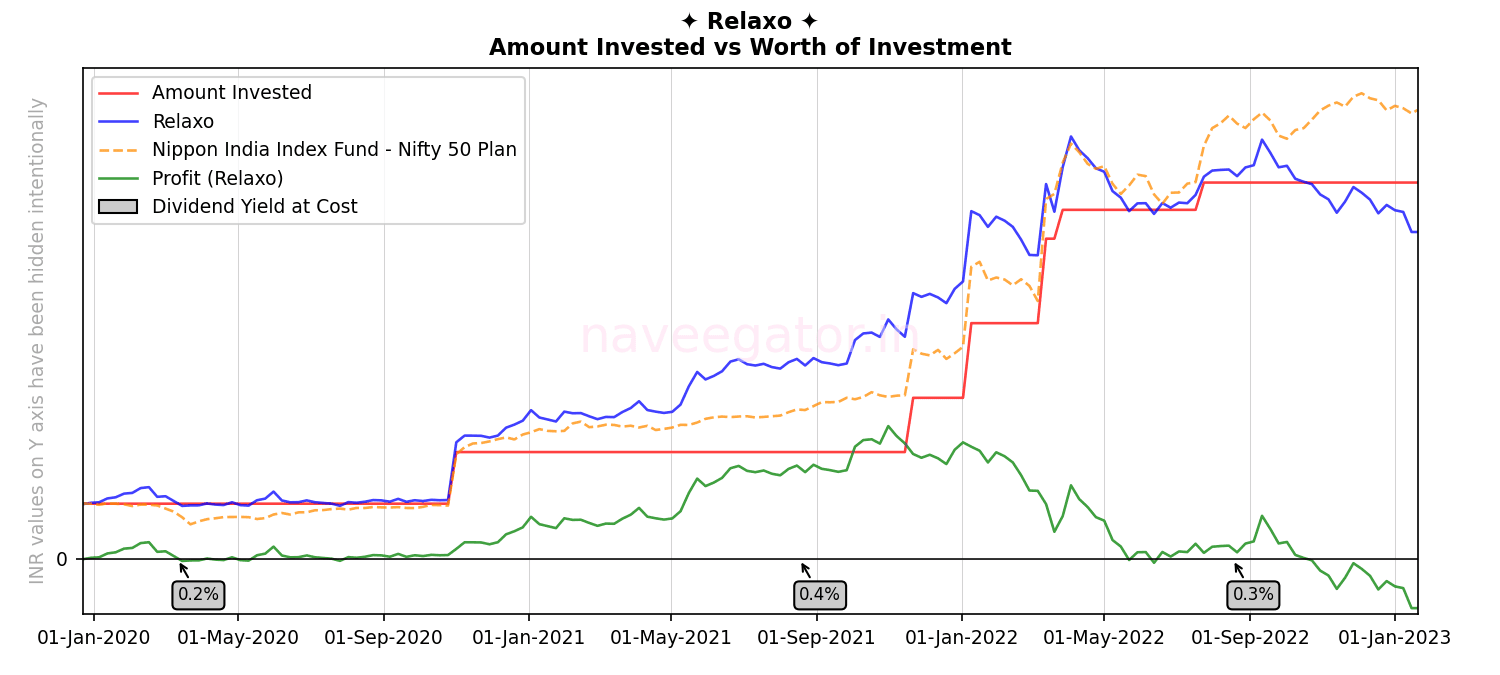

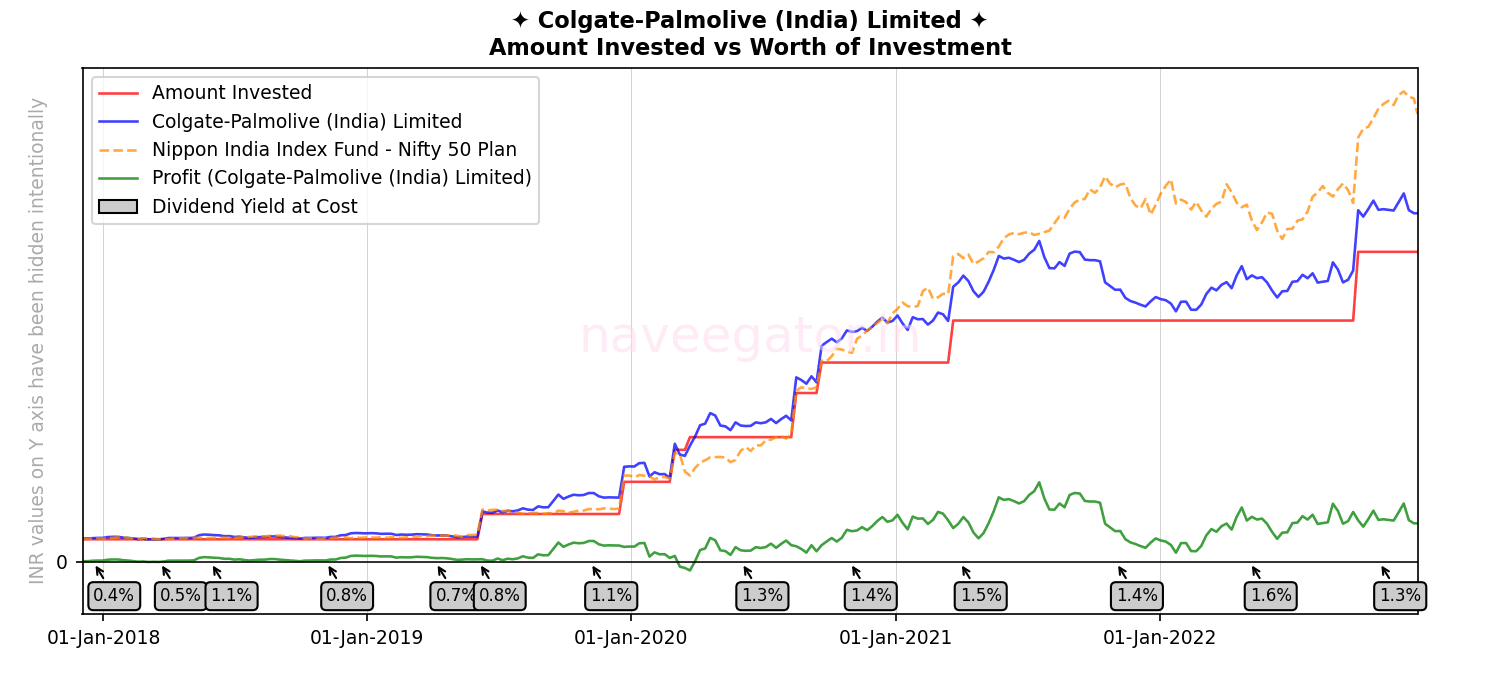

Investment through the years

Returns

The dividend yield at cost mentioned in the chart above, is yield at the date at which I received the dividends. Another way to look at dividend yield is to calculate it for the fiscal year.

| Fiscal year | Dividend yield at cost |

| 2019-20 | 1.86% |

| 2020-21 | 0.00% |

| 2021-22 | 1.45% |

| 2022-23 | 1.27% |

| 2023-24 * | 0.00% |

To calculate the dividend yield at cost in the above table I use the below formula.

(Total amount of dividends received in a fiscal year ÷ Total amount invested at the end of fiscal year) × 100

Profit Percent

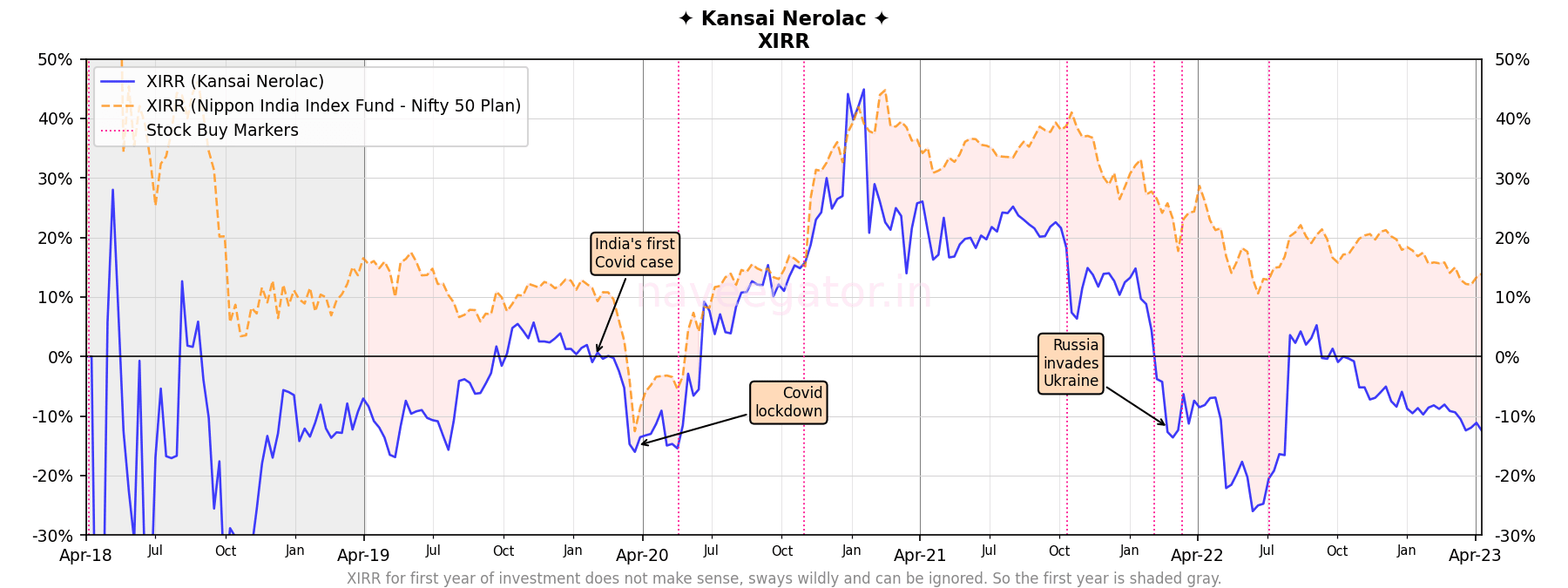

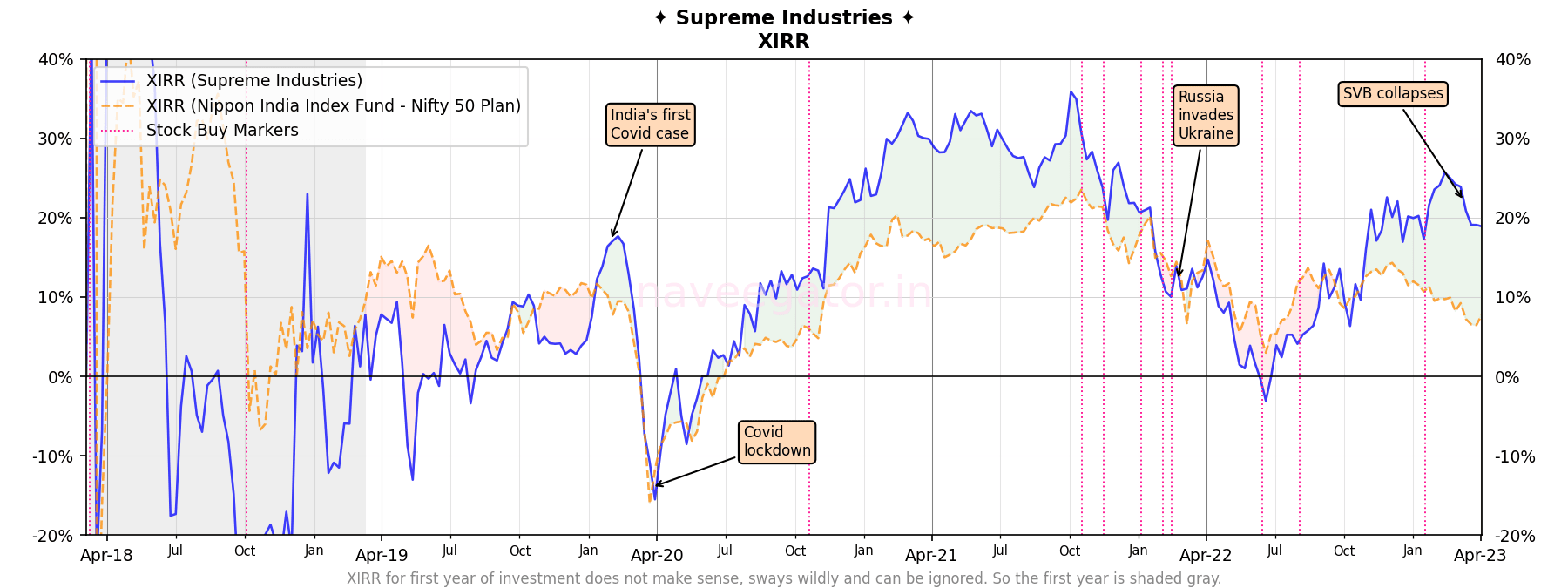

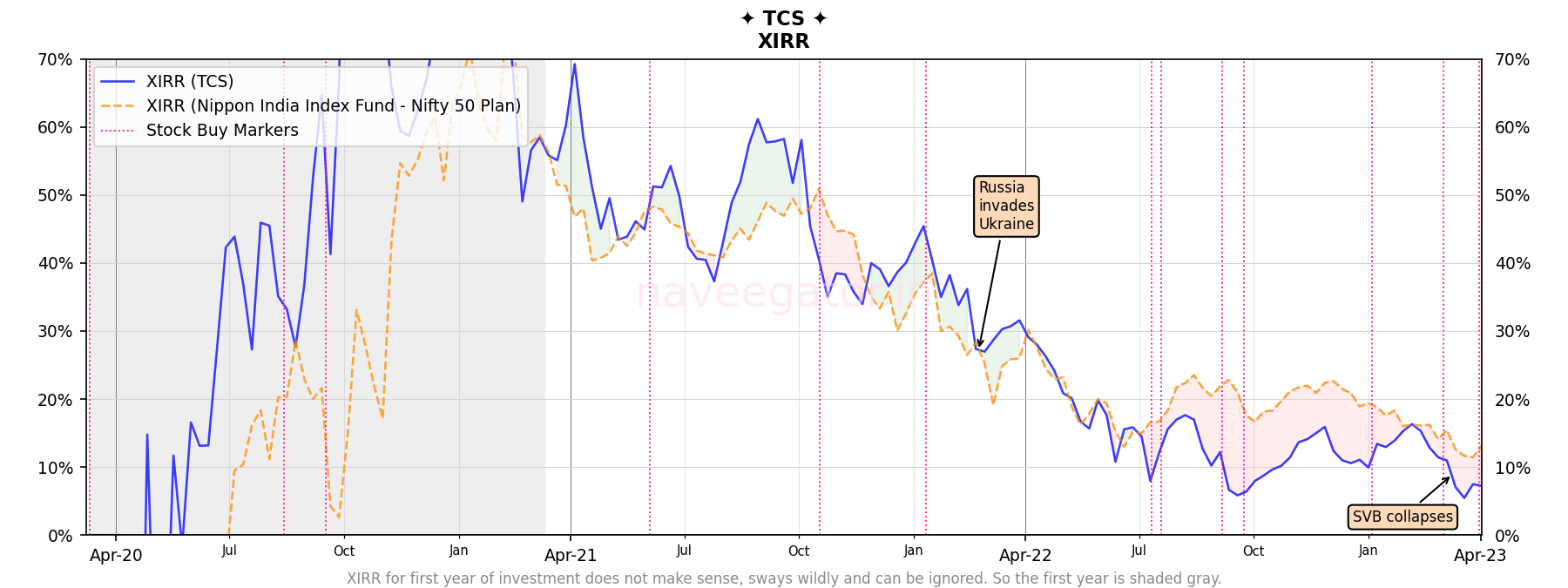

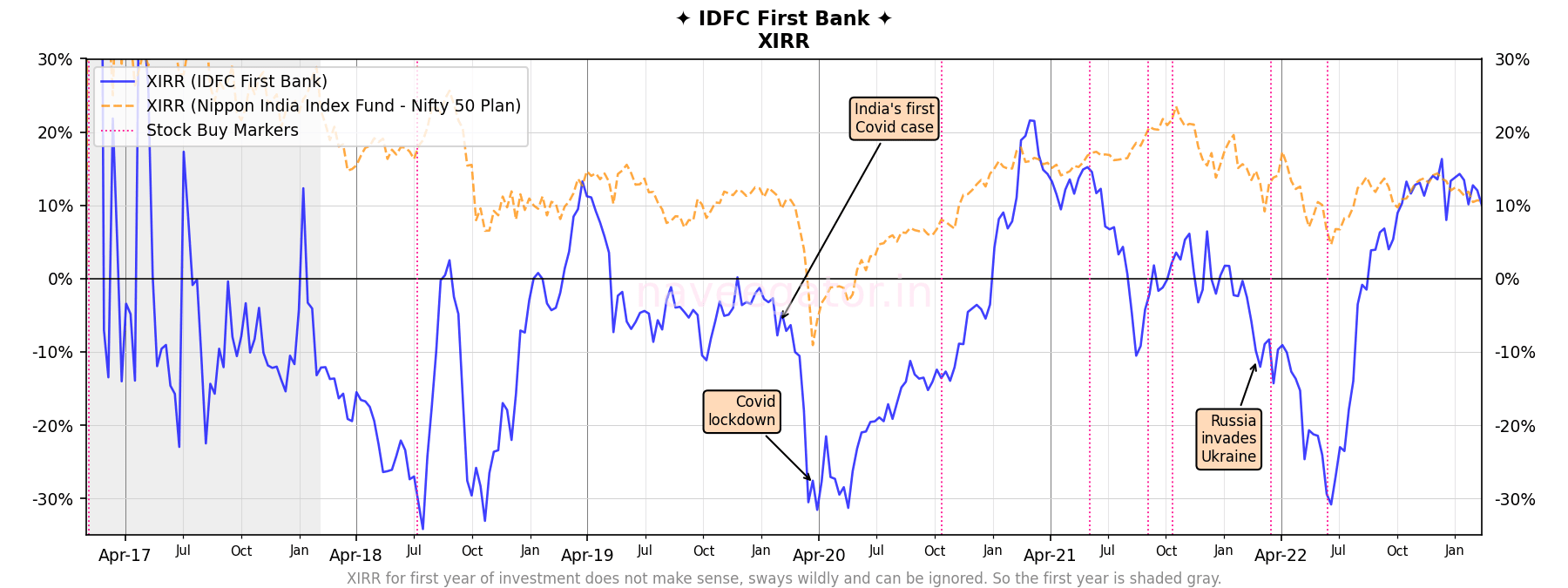

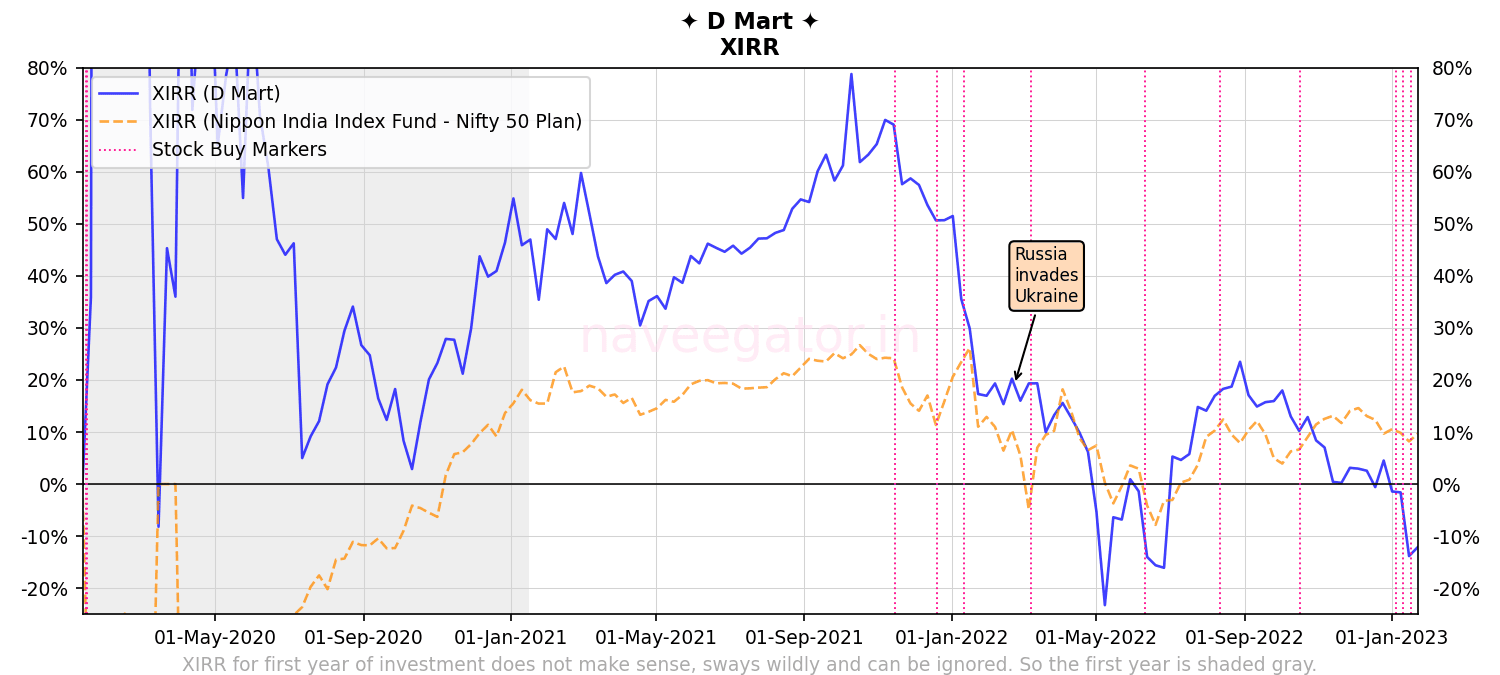

XIRR