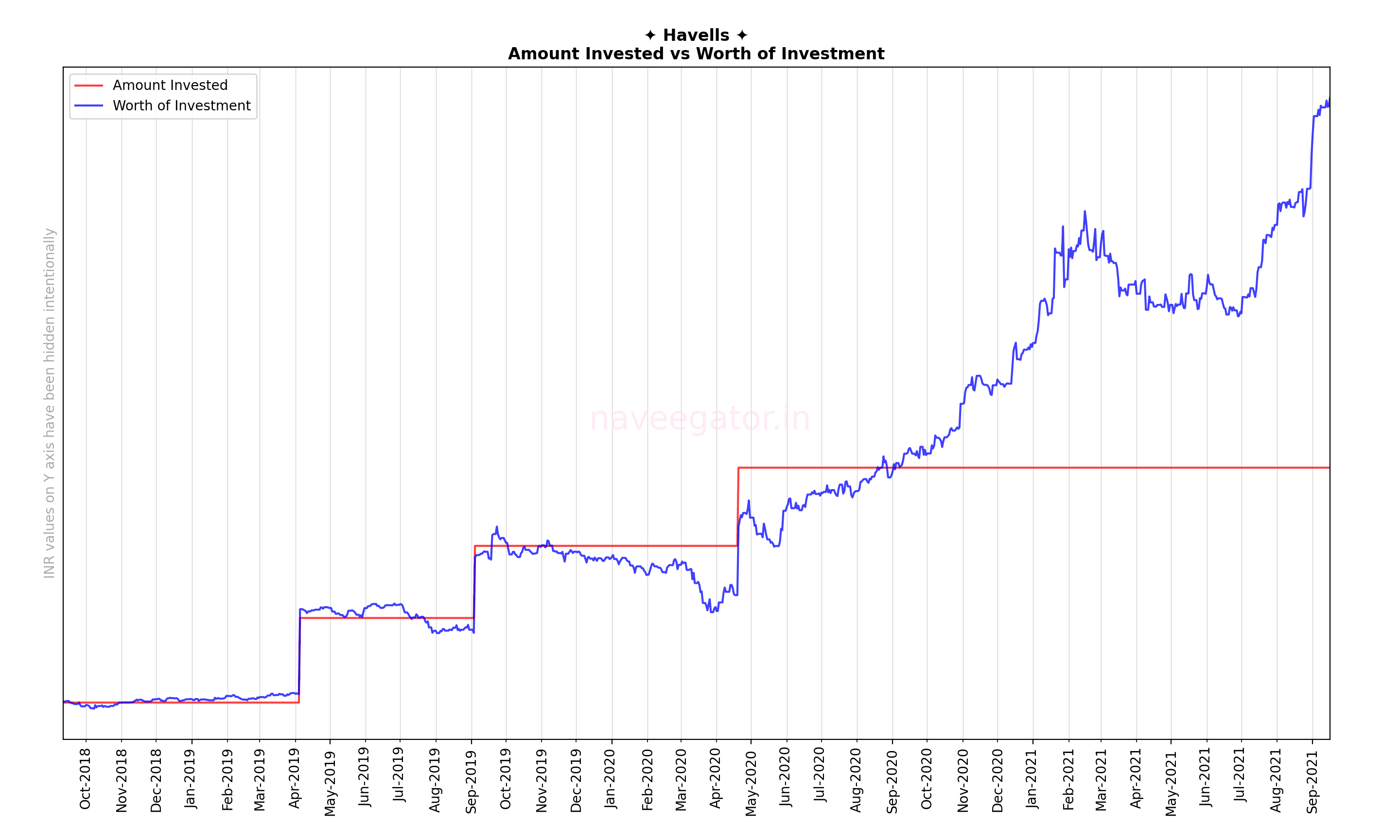

Three years ago I started investing in Havells. During the first two years the gains were pretty average. But during last one year the stock has zoomed and so has my returns.

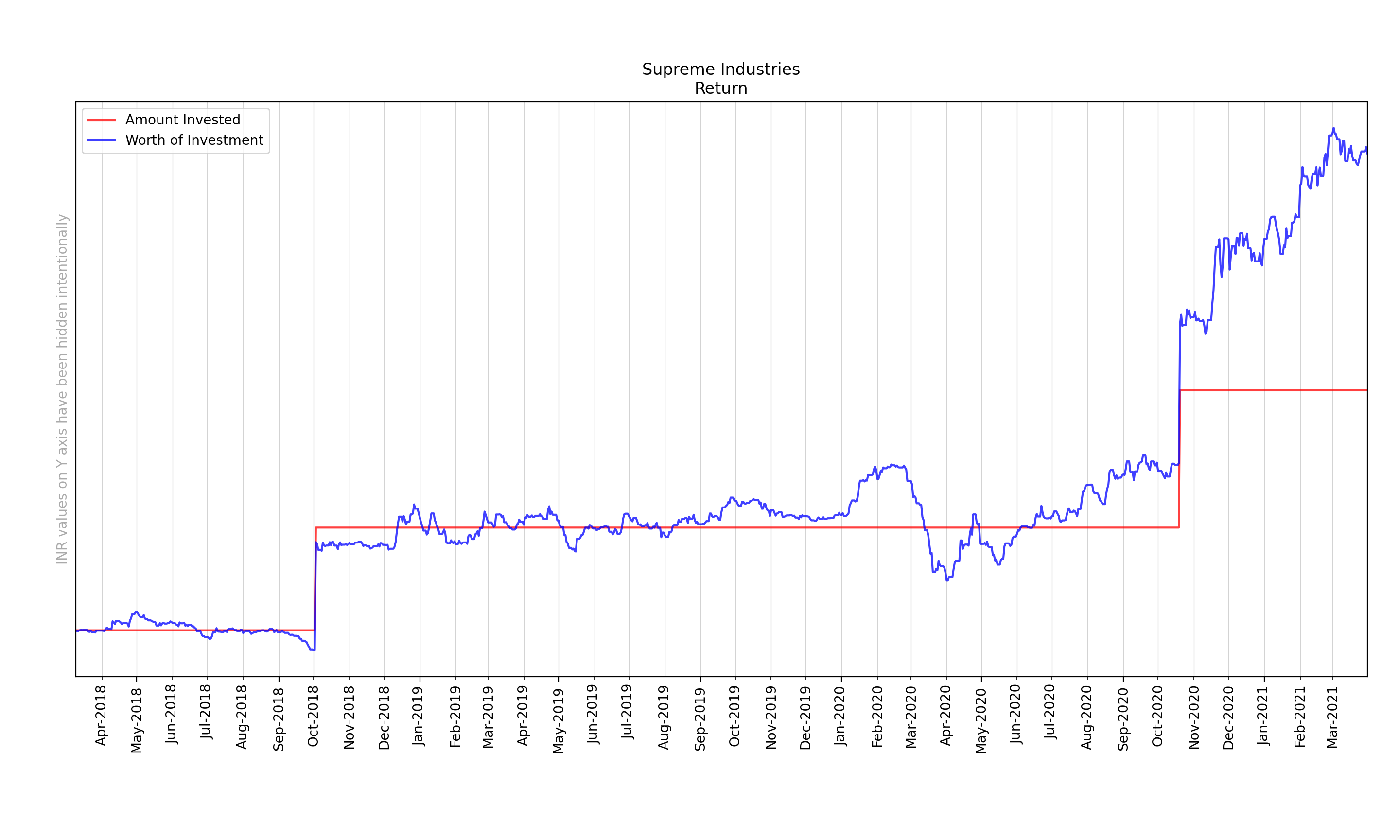

Return

I invested only four times in Havells and was planning to invest more, but at the current price I maybe overpaying.

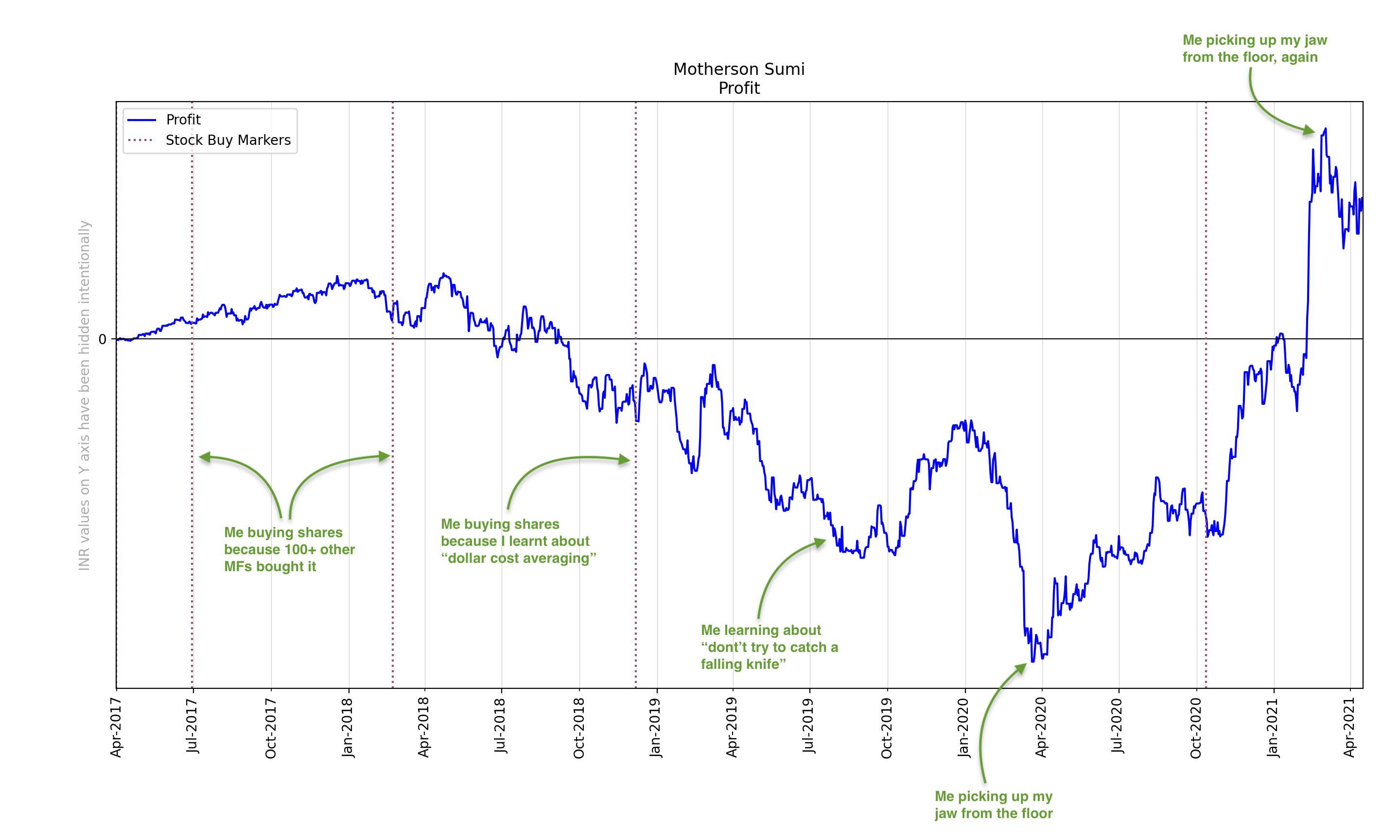

Profit

At the current price levels, my amount invested in Havells has more than doubled. While the amount invested wasn’t significant but the profit percent surely is.

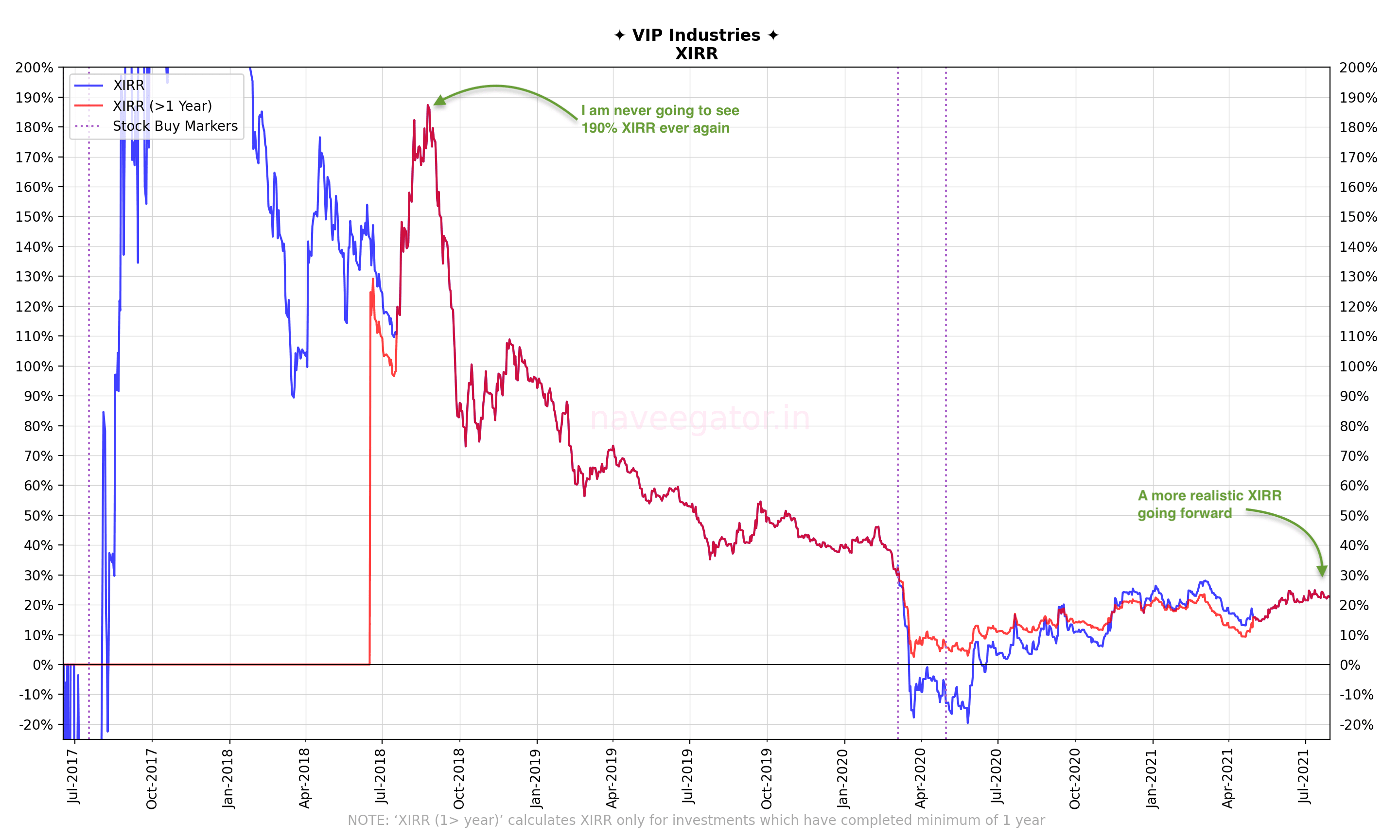

XIRR

The current XIRR of 45%—which is certainly impressive—is not sustainable in the long run. But with the good run that this stock is having I am hoping for fat returns of 20% over long term.

NOTE: XIRR for initial months varies wildly and is not useful for any analysis. But once the investments complete minimum of 1 year, XIRR gives me a much better picture. So I calculate ‘XIRR (>1 year)’ which calculates XIRR only for the investments which have completed minimum of one year while ‘XIRR’ continues to calculate for all the investments irrespective of how much time has been completed. There are some periods where ‘XIRR’ and ‘XIRR (>1 year)’ calculate to the same amount as for that time all my investments had completed minimum of 1 year.